An essential and resilient sector: why healthcare property

Colin Mackay, Research and Investment Strategy Manager, Cromwell Property Group

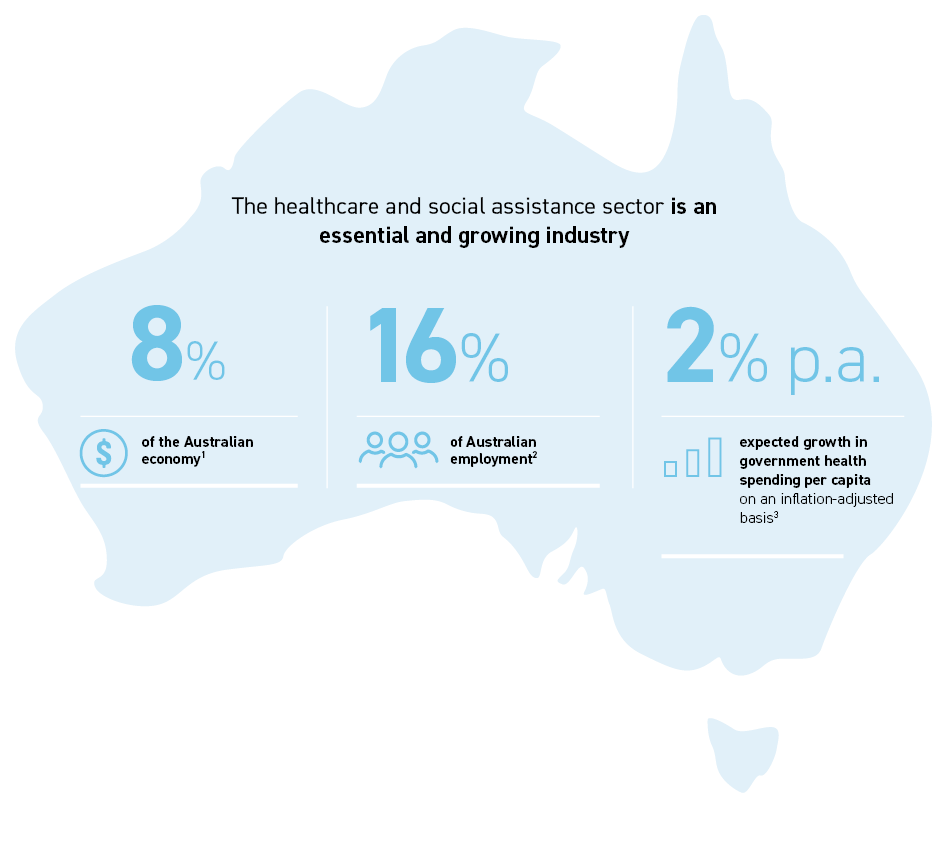

The healthcare and social assistance sector is an essential and growing industry, accounting for 8% of the Australian economy1 and 16% of employment2. It is expected to see the biggest increase in government funding from 2022-23 to 2062-63, with government health spending per capita forecast to grow by 2.0% p.a. on an inflation-adjusted basis3. In this short article, we’ll provide a brief overview of healthcare’s key growth drivers, and why healthcare property presents a compelling investment opportunity for income-oriented investors seeking stability and diversification.

Demographic tailwinds

Growth in Australian healthcare is underpinned by several long-term demographic trends, which are spurring demand for care services. Firstly, Australia is forecast to experience the strongest population growth across developed economies over the next decade4. On top of broad-based population growth, there is an even more pronounced “population bulge” now sitting in the 65+ age bracket due to the post-war baby boom. Life expectancy is also rising, up from 78 years (men) and 83 years (women) two decades ago to 81 and 85 today, with the rising trend expected to continue3. These factors mean the number of people aged 65+ will more than double and the number aged 85+ will more than triple over the next 40 years. As we live longer, the proportion of our lives lived in “full” health is slowly declining, meaning a longer period of time where health services and care are needed per person.