Why listed property deserves a place in investors’ portfolio – A conversation with Stuart Cartledge

Listed property has long been a staple for investors seeking sustainable income and exposure to commercial real estate. Yet, in recent times, some asset consultants and researchers have shifted allocations toward global real estate investment trusts (GREITs), citing concerns about concentration risk in the Australian market. To explore why listed property still deserves a place in a well-diversified portfolio, we sat down with Stuart Cartledge, Managing Director of Phoenix Portfolios, to discuss the opportunities in listed property, diversification strategies, and how Phoenix approaches the market.

Listed property has long been a staple for investors seeking sustainable income and exposure to commercial real estate. Yet, in recent times, some asset consultants and researchers have shifted allocations toward global real estate investment trusts (GREITs), citing concerns about concentration risk in the Australian market. To explore why listed property still deserves a place in a well-diversified portfolio, we sat down with Stuart Cartledge, Managing Director of Phoenix Portfolios, to discuss the opportunities in listed property, diversification strategies, and how Phoenix approaches the market.

What opportunities does listed property provide for investors?

According to Stuart, one of the key benefits of listed property is the ability to gain exposure to commercial real estate in a diversified and liquid manner.

“The key issue that most of us have with commercial real estate is that we don’t have enough money to achieve diversification, and we may not have a long enough investment horizon to forfeit the need for liquidity,” he explains.

Unlike direct property ownership, where selling can take months or even years, listed property allows investors to buy and sell easily on the stock market, providing much-needed flexibility.

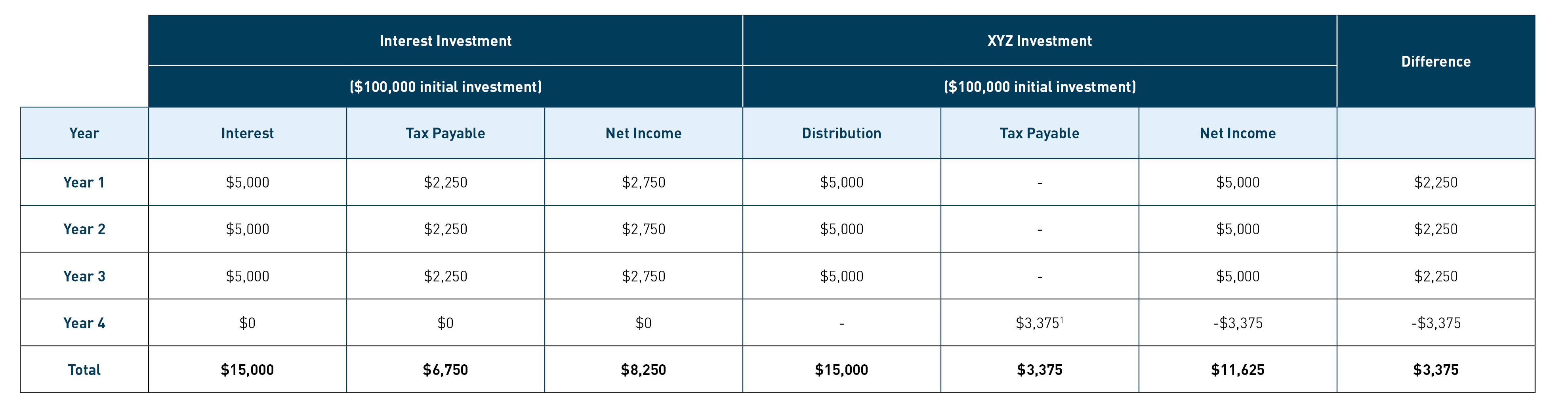

Beyond liquidity, listed property also offers sustainable, forecastable income streams. Most investments in the sector generate returns through ownership and rental income, with long-term leases often secured by blue-chip or government tenants. This makes the income more predictable compared to other asset classes.

A listed property investment typically derives the majority of its return through the ownership and rental of commercial real estate. Investors gain proportional ownership in a portfolio of commercial property assets, along with professional management to collect rent, maintain buildings, and, most importantly, distribute income to unitholders. Commercial real estate is typically leased on long-term contracts, often to blue-chip or government tenants, making the income stream reasonably forecastable and reliable.