1. You’ve been the Chief Investment Officer at Cromwell for the past five years, Rob – what does the role involve? What are some of the key responsibilities you take on daily?

The role has changed somewhat since I was first appointed, but the current role is responsible for Group Strategy, our Australian Funds Management business, Investor Relations, and Research. I also represent Cromwell on the Boards of our joint venture companies (Phoenix and Oyster) and, in the case of Oyster, I chair the Investment Committee.

On a day-to-day basis, I’m focused on thinking through what’s next for Cromwell Property Group and our suite of Funds Management products, while ensuring our existing balance sheet and retail products are appropriately and effectively managed.

2. You hold a Master of Science, focused on chemical physics, from The University of Glasgow – how did you transition from that field to the finance industry? Are there any transferable skills

between the two vocations?

I always enjoyed studying the sciences through school so, when it came to choosing what degree to do, I decided to choose something that clicked with me; something I enjoyed learning about. I had a great time at university, but never intended on becoming a professional scientist. In the summer before my final year, I spent two months in London with a large investment bank, working in their derivatives team – and I was hooked.

I applied to a number of investment banks to join their graduate programmes, and ultimately accepted an offer to join NM Rothschild & Sons for their 1998 intake.

I joined the bank around September that year, along with my fellow graduate programme members – which included geographers, linguists, and historians, among others. We embarked on a four-month on-the-job training programme, where I was taught financial analysis, presentation skills, basic legal skills, project management skills, and spent time on secondment across the various parts of the business. From then on, I spent eight years in investment banking in London and Australia before moving into property funds management.

There are a huge number of transferrable skills between science and finance. At Uni, I was taught how to independently think and motivate myself – the days of being chased and reminded by a teacher to complete an assignment were over. No-one else was going push me, I had to do that myself.

A science-based education teaches you strong analytical and problem-solving skills that can be used across any number of careers. I was taught how to observe, research, and think critically, all kills which can be used when approaching any task, be it in a laboratory, at an office desk, or in a boardroom.

3. There’s been considerable media attention given to the current state of the commercial property market over the past six months – how do you see the market in August 2023?

There is no denying that times are challenging and uncertain. The current volatility in interest rates and valuations is making investment decisions hard for investors, which is flowing through to low transaction volumes worldwide.

Recent data is looking more promising for Australia, but I think we still have some way to go until markets can settle down, interest rates become more stable, and investors have more confidence in deploying capital that is not just looking for opportunistic returns.

The other key focus is on leasing and maintaining our buildings to ensure we are keeping our occupancy high and that our buildings are attractive and relevant to existing and new tenants.

4. Given the environment, how does Cromwell navigate the uncertain market conditions to keep generating income for our investors?

A key focus for us in this environment is to protect our balance sheet. We have undergone a programme of noncore asset sales, the proceeds of which have been applied to reduce our outstanding debt balance and reduce gearing. These sales continue, particularly in Europe, where we are looking to return capital to Australia for investment locally.

The other key focus is on leasing and maintaining our buildings to ensure we are keeping our occupancy high and that our buildings are attractive and relevant to existing and new tenants.

5. In your opinion, what opportunities exist for Cromwell over the next twelve months?

With uncertain and volatile markets also comes opportunity. A key strategic goal for us in the short-to-medium-term is to expand and grow our Australian Funds Management business. We are looking to create a number of new products in the short-term to take advantage of some thematic trends we are seeing domestically.

We will be looking to expand our sector horizons outside of office and take advantage of our repositioning skills to look for opportunities where we can add value and additional life to existing assets.

We also see great opportunity to boost our funds under management and skill base through platform and portfolio acquisitions, much like our recently announced transaction between Cromwell’s Direct Property Fund and the Australian Unity Diversified Property Fund.

We have a great platform, loyal investors, and a broad skill set within Cromwell, which I think places us well to take the business to the next stage of its strategic plan.

We have a great platform, loyal investors, and a broad skill set within Cromwell, which I think places us well to take the business to the next stage of its strategic plan.

6. The merger of Cromwell’s Direct Property Fund with Australian Unity’s Diversified Property Fund was seen as a bright point for the business in 2023 – can you expand on the work that was put into the deal?

It’s a big deal for both funds, and one that took a lot of people to get to this point.

We’ve been working on the transaction for close to 12 months, working with multiple advisors across all disciplines. It has already involved every team within Cromwell and will continue to as we move towards the unitholder meeting and hopefully completion and integration into our platform.

It’s a great illustration of what can be achieved together, working alongside our colleagues, and being aligned to a common goal.

7. What are some changes or shifting attitudes/trends/practices that you currently see playing out in the commercial property market?

As businesses adjust to the post-COVID-19 environment and work practices, we are seeing tenant attitudes to office shifting. We are seeing larger occupiers, which traditionally fill Premium buildings with large floorplates, contract – while smaller tenants are expanding.

This is changing the adage of “flight to quality”. Historically, “quality” would have been synonymous with Premium – top grade, large floorplate office buildings with high rents, but this ignores the needs of most office occupiers, particularly those that are growing.

The majority Australian businesses (and employment) are small and medium-sized enterprises. These SMEs are in the market for a new ‘Toyota’, not a ‘Rolls-Royce’. They want the highest quality office, in the best location, within their price bracket. So “high quality office” is really the space that meets the needs and preferences of its target audience.

We are also seeing a shift to “experiences”, with tenants now increasingly focused on the whole package of location, local amenity, on floor experience and fit-out, natural light, third spaces and wellness, and proximity to transport. We are seeing this play out particularly in the city fringe areas where rents are growing strongly, given the lack of availability.

8. What do you enjoy most about your role?

I think it’s the variety of the role and being central to the growth of the business, helping to set and drive the strategy, creating new products, and building new relationships.

When I was in investment banking, we would move from one transaction to the next, but at Cromwell I can follow through on ideas and new opportunities, helping to build out the business and develop the culture.

About Stuart Cartledge

About Stuart Cartledge

The quarter started off on positive footing, with inflation across advanced economies edging down to 4.4% YoY in July1. Central Banks’ continued focus on inflation outcomes saw data moderate, helping to ease pressure on rates. However toward the quarter’s end, it was rising energy prices (in part driven by a supply halt by OPEC+) which posed some risk to the inflation outlook and therefore increasing interest rate expectations once again

The quarter started off on positive footing, with inflation across advanced economies edging down to 4.4% YoY in July1. Central Banks’ continued focus on inflation outcomes saw data moderate, helping to ease pressure on rates. However toward the quarter’s end, it was rising energy prices (in part driven by a supply halt by OPEC+) which posed some risk to the inflation outlook and therefore increasing interest rate expectations once again While expectations of further cash rate hikes have diminished, longer term interest rates (proxied by 10-year bond yields) remain ~40bps higher than a year ago4. This is continuing to put pressure on debt costs and is the main macro driver challenging property valuations, despite resilience across demand drivers.

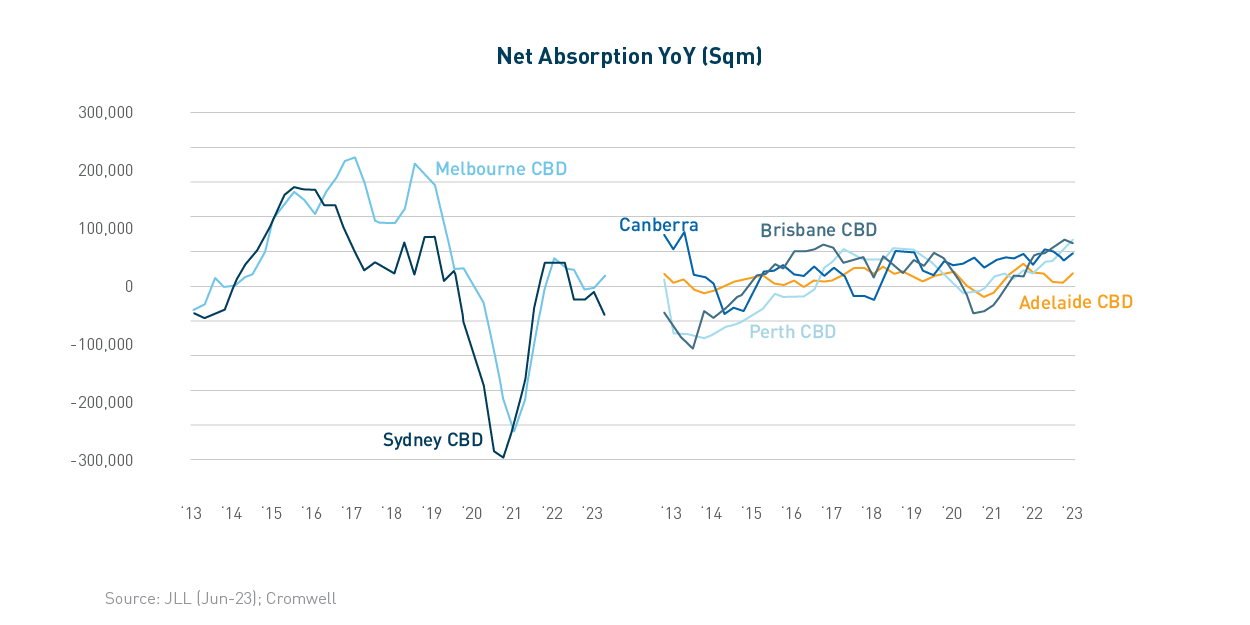

While expectations of further cash rate hikes have diminished, longer term interest rates (proxied by 10-year bond yields) remain ~40bps higher than a year ago4. This is continuing to put pressure on debt costs and is the main macro driver challenging property valuations, despite resilience across demand drivers. There continues to be mixed demand readings between the major CBDs, largely aligned to the different industry compositions of the markets. According to JLL Research, national CBD net absorption totalled around 1.5k square metres (sqm) across the quarter. The resource-based markets of Brisbane and Perth both continued their run of positive demand, which has now extended to over a year for each. Adelaide recorded the strongest CBD result with positive net absorption of 37.5k sqm, underpinned by the completion of a 40k sqm Prime office building at 60 King William St anchored by Services Australia. Sydney CBD recorded the weakest result on a quarterly and annual basis, with all precincts except the Core contracting over 3Q23. Prime net absorption was stronger than Secondary net absorption for the tenth consecutive quarter, with Sydney and Canberra the only CBD markets recording weaker net absorption across Prime stock.

There continues to be mixed demand readings between the major CBDs, largely aligned to the different industry compositions of the markets. According to JLL Research, national CBD net absorption totalled around 1.5k square metres (sqm) across the quarter. The resource-based markets of Brisbane and Perth both continued their run of positive demand, which has now extended to over a year for each. Adelaide recorded the strongest CBD result with positive net absorption of 37.5k sqm, underpinned by the completion of a 40k sqm Prime office building at 60 King William St anchored by Services Australia. Sydney CBD recorded the weakest result on a quarterly and annual basis, with all precincts except the Core contracting over 3Q23. Prime net absorption was stronger than Secondary net absorption for the tenth consecutive quarter, with Sydney and Canberra the only CBD markets recording weaker net absorption across Prime stock.

The impact of higher interest rates is being felt by consumers, with retail sales rising by a modest 0.7% over July and August combined. This was despite positive effects from warmer than normal weather and the Women’s World Cup boosting clothing and dining spending. Annual growth has slowed to 1.5% and with population growth running above 2%, real growth per capita is firmly in negative territory. On an annual basis, dining continues to record the strongest growth, followed by groceries. Tasmania is the worst performing market with nominal sales heading backwards year-on-year, while the ACT has been the top performer with annual sales growth of 5.5%.

The impact of higher interest rates is being felt by consumers, with retail sales rising by a modest 0.7% over July and August combined. This was despite positive effects from warmer than normal weather and the Women’s World Cup boosting clothing and dining spending. Annual growth has slowed to 1.5% and with population growth running above 2%, real growth per capita is firmly in negative territory. On an annual basis, dining continues to record the strongest growth, followed by groceries. Tasmania is the worst performing market with nominal sales heading backwards year-on-year, while the ACT has been the top performer with annual sales growth of 5.5%.