1. Can you walk us through your role at Cromwell, Lara? What are some of the key responsibilities you take on daily?

As it is for many other people, I find that no two days are alike in my role. My key responsibility is to ensure the delivery of the ESG ambitions and commitments that Cromwell has set out while continually building on this ambition. That entails working closely with every facet of the business, and our value chain, to fully integrate ESG into everything we do.

I am committed to ensuring that we aren’t just talking ESG but delivering tangible action to drive sustained positive change. To achieve this, we need everyone to fully understand what ESG means in their world. As such, part of my role is helping to translate what ESG is and what it looks like in different areas of the business.

We don’t need everyone to be an ESG expert; however, we do need everyone to fully appreciate, and deliver on their part, to ensure Cromwell is an environmentally and socially sustainable business. Another important facet of my role, with the help of my team, is to make sure these initiatives happen at pace – and that we provide guidance, direction, and support whenever and wherever needed.

ESG is a framework that helps stakeholders understand how an organization is managing risks and opportunities related to environmental, social, and governance criteria.

2. Looking back, how did your career in ESG and sustainability begin – where did your interest originate?

As cheesy as it sounds, I’ve always wanted to make a difference. I didn’t always know exactly how or in what field, but I’ve always known that I wanted to help make a positive change on the biggest scale possible.

After completing a Bachelor degree in Biology in Southwest France, I realised that the biggest impact I could have would be to help drive positive change within corporate organisations, and thus went on to complete an MBA specialised in sustainable development and environmental management at La Rochelle International Business School. Following my studies, I led a variety of sustainability and ESG roles, always in the most carbon intensive industries, with the aim to achieve my ambition of helping make a difference on the biggest scale possible.

3. In the last decade, particularly, there has been an increasing emphasis on sustainability within the property sector. How does Cromwell intend to manage the expectations of investors, tenants, and staff regarding ESG now; and what does the future hold for Cromwell regarding ESG?

Indeed, the pace of change and maturity regarding sustainability and what it is (and isn’t) has grown exponentially, and I anticipate this will only continue. I expect the breadth of topics will also continue to expand.

For example, some in the industry can still be somewhat biased, and/or have tunnel vision, solely focusing on greenhouse gas emissions and achieving net zero; however, while reducing emissions is crucial, this cannot be at the expense of biodiversity, social value, or natural capital. These topics are all interlinked, and we cannot be successful by focusing on each in isolation. While the industry needs to remain pragmatic, we also need to balance this with a wholistic systems view.

In the spirit of ensuring we aren’t just talking about ESG but delivering tangible action, Cromwell is always actively looking to implement circular and sustainable practices, in addition to constantly seeking opportunities to reduce emissions at scale and at source. Cromwell Property Group has committed to achieve net zero for its entire portfolio for Scope 1, 2 and 3, including tenant emissions and embodied carbon, by 2045 and net zero operational control by 2035.

As a fund manager, a significant proportion of our emissions fall into to our Scope 3 footprint.

Additionally, the business has committed to continuously positively contribute to the communities it operates in and support tenants with their evolving needs. Cromwell has set targets to improve tenant-customer satisfaction to a minimum score of 80% and achieve and maintain an employee engagement score of 80% or higher across the business by 2030.

In terms of what the future holds for Cromwell, the Group recognises the industry challenges relating to environmental, social, or governance topics. While it’s not the easy option, the Group is not shying away from these challenges. As an example, despite the challenges many Cromwell is always actively looking to implement circular and sustainable practices, in addition to constantly seeking opportunities to reduce emissions at scale and at source in the industry face around data quality and availability for Scope 3 emissions, we recognise that this emission scope represents a significant part of the Group’s footprint. We are therefore proactively engaging clients and tenants to obtain Scope 3 data via the roll out of our green lease initiative. We have already achieved 24% roll-out of green leases across our CEREIT portfolio since this initiative was launched. And it’s not just about data collation, Cromwell is proactively engaging its value chain partners about volunteering opportunities within the local community often supporting them with their own ESG agendas.

Cromwell is always actively looking to implement circular and sustainable practices, in addition to constantly seeking opportunities to reduce emissions at scale and at source.

Lara Young – Group Head of ESG, Cromwell Property Group

4. What are some changes or shifting attitudes/trends/practices that you currently see playing out in the corporate ESG space?

Several come to mind. The corporate ESG space has suffered from a constant flow of buzz words, jargon, and acronyms that have led the topic to be inaccessible, overwhelming, and confusing for many. While understanding the nuances of the many definitions is important, there has been a significant effort to simplify and harmonise language and approaches.

There is still some way to go in this regard; however, through this effort, we have seen the ESG agenda seep into disciplines that historically it was omitted from.

This simplification effort has provided greater awareness about ESG across the general public, organisations, and governments which, in turn, adds to the increasing pressure for all to demonstrable evidence the tangible actions and ESG results they are and have delivered so far.

With this growing maturity – and understanding as to what is credible and what is greenwashing – I expect we will soon see greater accountability and assurance from regulators and policy makers on corporate ESG commitments made. This will result in raising the industry norms and standards, positive recognition for those that have delivered on their commitments and litigation and penalties for those that are unable to provide quantifiable and robust results of the ESG benefits delivered.

5. What opportunities regarding ESG excite you, and how do you think Cromwell’s strategy overall could be developed moving forward?

I’m excited about the opportunity to deliver tangible positive change at scale, and not just at Cromwell but in collaboration across the industry with our value chain. Nearly every actor in the industry is faced with the same challenges, and I’m a great advocate of not reinventing the wheel, but rather ensuring that we support and learn from each other. No single organisation can achieve this agenda alone and the opportunity to collaborate at such scale and with so many other disciplines is hugely exciting.

Cromwell’s ESG agenda is a long-term plan that will have to evolve as the ESG agenda matures over the years to come. There is no perfect plan; however, our approach to ensure we recognise, adapt and deliver as the ESG agenda evolves which will ensure Cromwell’s strategy remains aligned to the industry needs.

6. What do you enjoy most about your role?

There are many things I enjoy about my role, but the people I get to meet, engage, and work with is the aspect I enjoy most. Successfully delivering and bringing to life an ESG strategy is a huge team effort that no one person can deliver alone. Thanks to the diversity of my role and the fact that ESG impacts every facet of the organisation and wider industry, I am fortunate to meet many brilliant and inspiring individuals from who I learn a great deal.

About Stuart Cartledge

About Stuart Cartledge

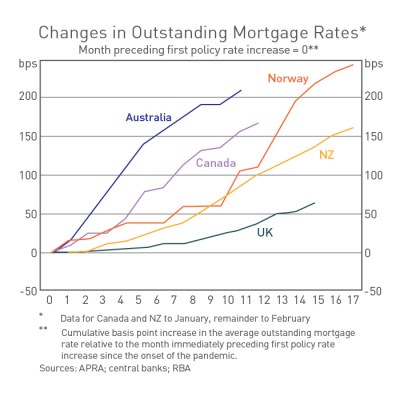

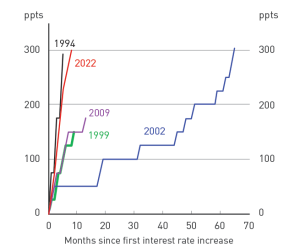

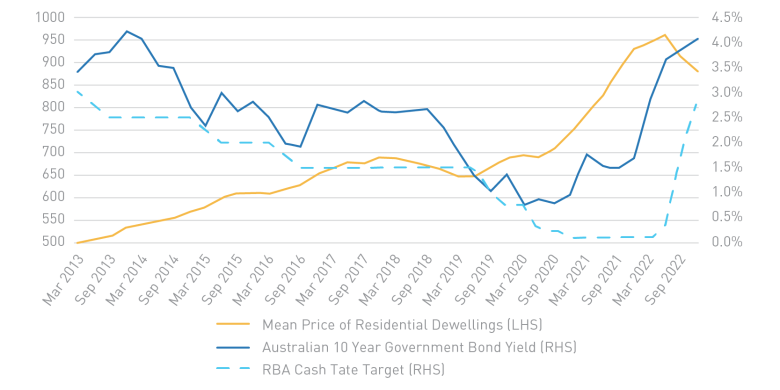

To illustrate this point. The Reserve Bank of Australia’s Target Cash Rate (Cash Rate) has moved from 0.1% to 4.10%. The monthly repayments on a $900,000 mortgage today are equivalent to the monthly repayments on a $1,420,458 mortgage when the Cash Rate was 0.1%. The change in house prices will naturally (inversely) follow changes in interest over time, albeit with somewhat of a lag. This can be seen in the chart on the right-hand side. Note how home prices accelerated when interest rates were at record lows.

To illustrate this point. The Reserve Bank of Australia’s Target Cash Rate (Cash Rate) has moved from 0.1% to 4.10%. The monthly repayments on a $900,000 mortgage today are equivalent to the monthly repayments on a $1,420,458 mortgage when the Cash Rate was 0.1%. The change in house prices will naturally (inversely) follow changes in interest over time, albeit with somewhat of a lag. This can be seen in the chart on the right-hand side. Note how home prices accelerated when interest rates were at record lows.