On 15 May 2024, Cromwell announced the sale of the Cromwell Polish Retail Fund for €285 million ($465 million) to Star Capital Finance, a diverse real estate investor based in Prague.

Later that month, Cromwell informed the market that we had entered into a binding agreement for the sale of our European fund management platform and interests – including the Cromwell Italy Urban Logistics Fund and Cromwell European REIT – for a total consideration of €280 million ($457 million) to a Geneva-headquartered, multi-strategy real estate investment manager, Stoneweg SA Group.

Speaking on the European platform sale agreement at the time, Cromwell Chair Dr Gary Weiss said, “this is a turning point for Cromwell to focus on leveraging the exceptional team we have in Australia; to drive value from our local asset and funds management business.”

“In the current operating environment, numerous options were considered to simplify and de-risk the business, and we believe that this transaction will provide the debt reduction and working capital needed to move forward in a focused and value-accretive way.”

Now, with the sale of the European fund management platform sale finalised, Cromwell is completing the simplification of the business, and entering the next exciting phase of our strategy.

We are continuing to refocus on traditional property sectors primarily in Australia – a market in which we have a proven record of active asset management, driving value through enhanced leasing activities, asset upgrades, and ESG repositioning.

In this article, we will examine some of the property sectors that have been identified for future investment, following the settlement of the European platform. Our investment approach is guided by both top-down and bottom-up analysis, with consideration given to a number of cyclical, structural, and secular drivers of performance – such as behavioural shifts, demographic demands, economic factors, market fundamentals, and investor requirements.

This is a turning point for Cromwell to focus on leveraging the exceptional team we have in Australia; to drive value from our local asset and funds management business.

Dr Gary Weiss – Chair, Cromwell Property Group

Office building investment

In Australia, Cromwell manages an investment portfolio of $2.2 billion and funds management platform of $1.5 billion. Central to our business success has been, and will remain, office buildings in large metropolitan centres. We view several segments of the sector as favourable for investment, including Core/Core+ Value Add, Creative Fringe, and ESG Rejuvenation.

Core/Core+ Value Add

The ‘core’ category of office property investments includes a focus on high-quality, stable properties located in prime markets – particularly capital city CBDs. The hallmark of core investments is their ability to generate consistent, long-term income through different cycles and market conditions. These properties form the foundation of Cromwell’s current Australian investment portfolio.

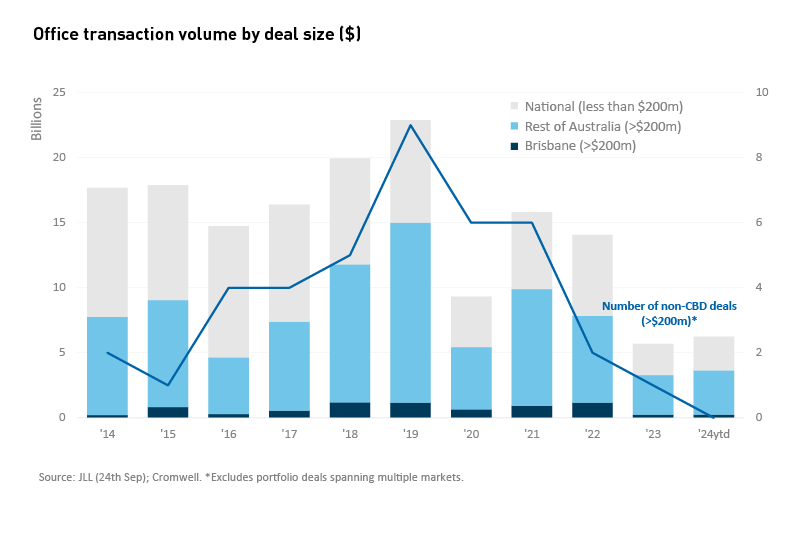

While the office sector continues to face challenges due to global market pressures, there are nuances across and within markets regarding vacancy rates and rental growth outlooks. In Brisbane, for example, the CBD vacancy rate is at the lowest level since 2012, and occupied space has increased since the onset of the pandemic, contributing to higher rents1. Similarly, the majority of Australian CBD buildings remain well-occupied, with real estate investment research company CBRE estimating more than half of all office buildings have vacancy of less than 5%2. This disconnect between sentiment and actual market conditions presents opportunities for investors to acquire quality office assets at attractive prices.

At this point in the cycle, we also see substantial opportunity to generate additional value for investors by leveraging the skills and expertise of our in-house property and project management teams. Delivering carefully considered capital improvements, space fit-outs, and a targeted leasing strategy, can reposition an asset’s appeal to potential occupiers. This process has been successfully repeated by Cromwell across our assets in recent years.

![]()

The healthcare and social assistance sector remains an essential and growing industry, accounting for 8% of the Australian economy5 and 16% of employment6. Healthcare property encompasses a range of asset types, from hospitals to medical centres, life science facilities and specialist disability accommodation. While some sub-sectors – such as private hospitals – are facing well publicised issues, we believe medical centres/offices are resilient to these challenges and well placed to benefit from several demand tailwinds. These assets are essential to communities across the country, providing a range of primary and secondary care such as GP, specialist, and allied health services.

The healthcare and social assistance sector remains an essential and growing industry, accounting for 8% of the Australian economy5 and 16% of employment6. Healthcare property encompasses a range of asset types, from hospitals to medical centres, life science facilities and specialist disability accommodation. While some sub-sectors – such as private hospitals – are facing well publicised issues, we believe medical centres/offices are resilient to these challenges and well placed to benefit from several demand tailwinds. These assets are essential to communities across the country, providing a range of primary and secondary care such as GP, specialist, and allied health services. Industrial property has been the top-performing real estate sector over the past decade13, propelled by strong rental growth as demand for space outpaced development of new supply.

Industrial property has been the top-performing real estate sector over the past decade13, propelled by strong rental growth as demand for space outpaced development of new supply. Convenience retail property assets are generally smaller, standalone shopping centres – often anchored by supermarkets – that service the surrounding suburbs by providing convenient access to essential goods and services.

Convenience retail property assets are generally smaller, standalone shopping centres – often anchored by supermarkets – that service the surrounding suburbs by providing convenient access to essential goods and services.

2. What appealed to you about joining Cromwell Property Group?

2. What appealed to you about joining Cromwell Property Group? 4. The last few years have been challenging for markets across the world – how does the current environment compare to previous market downturns that you’ve helped guide organisations through?

4. The last few years have been challenging for markets across the world – how does the current environment compare to previous market downturns that you’ve helped guide organisations through?

Cromwell has completed Stage 2 of our programme of works to install solar panels on buildings at locations across the country, as part of the business’s commitment to meet our long-term ESG targets.

Cromwell has completed Stage 2 of our programme of works to install solar panels on buildings at locations across the country, as part of the business’s commitment to meet our long-term ESG targets.