Learn

December 2024 direct property market update

Economy1

Some of the biggest events of the quarter happened far from our shores, none bigger than the US election where the incumbent Democratic Party ceded control of the Senate and Donald Trump secured the keys to the White House. This was the biggest election year in history globally2 and it turned out to be a year where voters turned against incumbents, with the final quarter also seeing Japan’s ruling Liberal Democratic Party reduced to coalition government. The US and Japan results followed similar outcomes in the likes of India, South Africa and the UK earlier in the year.

Cost-of-living pressures and the state of economies more broadly appear to have contributed significantly to election results. In Australia, the economy continues to fare relatively well compared to peer markets. Underlying inflation is tracking towards the target band and the labour market is a particular bright spot, with only 3.9% of those in the labour force unemployed. However, population growth is doing a lot of heavy lifting – this quarter saw the release of September GDP data, which showed real GDP growth of 0.8% year-on-year but a per capita decline of -1.5%.

The final quarter of the year is where the rubber hits the road for businesses – particularly retailers – exposed to the discretionary wallets of households. On this front, sales events such as Black Friday and Cyber Monday are becoming increasingly important. These events have shifted promotional activity (and spending) earlier, from December to November. While official ABS data for November retail sales are not available at the time of writing, higher frequency trading indicators from some of the banks suggest the promotional period did generate strong growth, led by discretionary non-food categories such as clothing. However, a more accurate assessment of performance over the quarter requires December data to be released (early February) given the slowdown that now tends to occur after the sales events conclude. While it does appear that the Stage 3 tax cuts and easing inflation pressures are providing some degree of stimulus to discretionary spending, a more significant improvement in retail growth may not be seen until cash rate cuts materialise.

Office

It was another positive quarter for office space fundamentals to end the year. Analysis of JLL Research data indicates over 30,000 square metres (sqm) of positive net absorption (demand) was recorded across the major CBD markets in aggregate, taking net absorption to over 160,000 sqm for 2024. This was the strongest year (on a rolling basis) for net demand since mid-2019. The positive quarterly result was relatively broad-based, with every CBD market except Melbourne (-1,800 sqm) and Perth (-2,300 sqm) recording demand expansion. Brisbane CBD was the top performer, underpinned by solid demand across small and large occupiers. Sydney CBD also performed well, with small occupiers leading the demand for space.

While demand was solid, supply completions contributed to the national CBD vacancy rate nudging 0.1% higher to 15.2%. This was almost entirely driven by Sydney CBD, where vacancy increased in every precinct except the Core. The vacancy rate remained flat or decreased in every other CBD market except Perth (+0.1%), with Brisbane CBD the strongest performer due to demand tailwinds and no stock completions over the quarter. In a positive indicator for the future direction of the vacancy rate, sub-lease vacancy has now reverted to the long-term (20 year) average, as large occupiers have re-absorbed space they were previously offering to the leasing market.

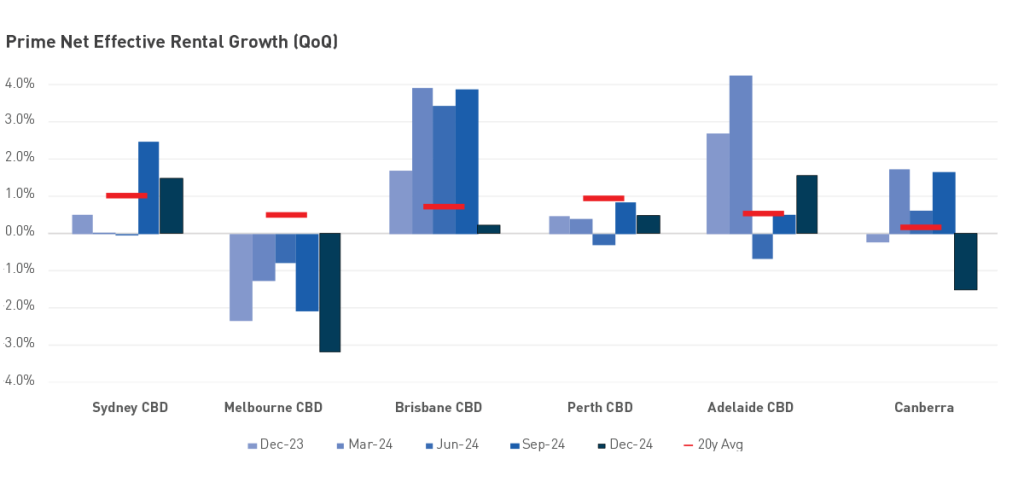

The pace of national CBD prime net face rent growth (+1.2%) remained slightly above the long-term average over the quarter and contributed to strong growth of 5.0% over the year. Every market recorded rent growth with Adelaide CBD the biggest improver (+1.6%). Incentives were largely unchanged except for Canberra (+0.6%) and Melbourne CBD (+1.4%), with net effective rents in those two markets falling as a result. Brisbane CBD took a breather after three consecutive very strong quarters, however supply-demand conditions remain favourable. Sydney CBD recorded another solid quarter, somewhat masking a two-speed market where the Core continues to outperform other precincts.

Transaction volume exceeded $2 billion for the third quarter in a row. This took the annual figure to $8.4 billion, a healthy increase of nearly 50% compared to 2023. While deal activity is still some way short of pre-COVID levels, there are signs that capital has started to move the office sector out of the ‘do not touch’ bucket. Sydney CBD accounted for the largest transaction of the quarter, BGO’s ~$580 million acquisition of 10-20 Bond Street. There was also elevated activity in some Sydney fringe and suburban markets which lifted overall Sydney transaction volume to $1.4 billion. Consistent with its stronger underlying fundamentals, Brisbane continued to comprise an above-average share of national deal activity. Melbourne recorded its weakest calendar year of transaction volume since the Global Financial Crisis, reflecting the vacancy challenges and uncertainty that persist in that market.

Across the major CBD markets, average prime yields expanded by 12.5 basis points (bps) in Brisbane and 25bps in Melbourne – all other CBDs were unchanged. Melbourne yields are now in line with Brisbane, a rare position, as investors demand a higher risk premium to account for the southern state’s weaker outlook.

Retail

Space market fundamentals improved across core retail (Regionals/Sub-Regionals/Neighbourhoods) with the vacancy rate decreasing for every centre type over the last six months (biannual data print). Regional and Sub-Regional centres now have a lower vacancy rate than pre-COVID. A lack of supply has contributed to the tightening of conditions with core retail stock growth of only +0.7% recorded over 2024.

Despite an improving supply-demand balance, rent growth was relatively muted over the quarter. While Regionals and Sub-Regionals recorded strong net rent growth in South East Queensland, Sydney Neighbourhoods was the only other segment to record material growth. On an annual basis, the rent growth rate seen over 2024 was the strongest achieved since 2011 for every sector.

Transaction volume totalled ~$1.8 billion for the December quarter, taking the 2024 figure to $6.3 billion. Activity over the quarter was buoyed by the Regional sub-sector, specifically the circa $900 million acquisition of QIC’s Westpoint Shopping Centre by Haben and Hines. Sub-Regional activity was also solid with nearly $500 million of deals recorded for the centre type, slightly exceeding the five-year quarterly average. It was a relatively quiet quarter for convenience retail, with less than $200 million of Neighbourhood centres changing hands. There were further signs that the cycle is starting to turn for the retail sector, with no yield expansion recorded for any centre type or market. Sydney yields compressed across every centre type after nearly $1.3 billion of transaction evidence over the quarter.

Industrial

Occupier take-up (gross demand) maintained last quarter’s level of around 840,000 sqm, remaining in line with the quarterly average of the past five years. Manufacturing had its second-highest quarter of demand on record (back to 2007) accounting for 40% of take-up. There were also large sites leased by individual users in smaller industries such as healthcare and equipment storage. Space demand was concentrated in Melbourne and Sydney, with both markets recording their strongest quarter in over a year. Brisbane was a relative drag and well down on its average level of the past three years, with only one lease greater than 9,000 sqm signed and the total number of lease deals decreasing versus last quarter.

Rent growth remains above the long-term average despite a weakening of demand relative to supply. The quarterly pace of rent growth was mixed across markets. In precincts where rents moved, strong growth was achieved. However, rents were unchanged in 12 of 22 precincts nationally, dragging headline growth rates. Brisbane was the standout performer with all three precincts recording rent growth of at least 3.7% (QoQ). Perth performed worst relative to last quarter as rents were unchanged across all of its precincts. Incentives had a limited impact on effective rent growth. They increased in Sydney’s outer ring precincts – where take-up is more driven by new developments and higher face rents were recorded over the quarter – but were largely unchanged across the other markets.

While over 900,000 sqm of industrial supply was earmarked for completion in the final quarter of 2024, less than 600,000 sqm was actually delivered as construction delays continued to push out project schedules. This theme is helping to maintain a reasonable supply-demand balance despite a record level of supply being delivered in 2024. Supply delivered over the quarter was concentrated in Melbourne, with completions in Sydney and Brisbane relatively muted. There are currently nearly 1.8 million sqm of floorspace under construction and due to complete in 2025. A key determinant of underlying space market conditions over the year will be how much of the planned development pipeline not currently under construction actually proceeds to commencement.

It was a fairly weak quarter for transaction volume, owing to a lack of large portfolio deals and weak activity in Melbourne (after a record quarter previously). While every other quarter during the year had a top transaction value of at least $600 million, the biggest transaction in Q4 was less than $200 million. Prime yields were relatively stable, with 25bps of expansion in two Melbourne precincts the only notable movements.

Outlook

There are still some offshore factors that could knock the Australian economy off course, namely geopolitical developments (e.g. Trump tariffs), conflict in the Middle East, and China’s waning economic growth. Positively, local conditions are largely evolving as hoped with inflation continuing to moderate as labour market gains are retained. While expectations continue to bounce around as new data is released, markets are currently forecasting at least one RBA rate cut by May3. This growing confidence that a rate cut will land in the first half of the year is supporting the stabilisation of commercial property market pricing which now appears to be occurring across all the sectors.

With capital market conditions appearing to improve and liquidity constraints easing, the strength of underlying property fundamentals should come into sharper focus. Opportunities that are aligned to Australia’s population growth tailwinds are well positioned, as are those where sentiment has become dislocated from property performance.

How did the Cromwell Funds Management fare this quarter?

How did the Cromwell Funds Management fare this quarter?

In the last quarter, approximately 28% of the Cromwell Direct Property Fund’s (Fund) portfolio was revalued, with a further 19% revalued in October during the December quarter. This resulted in a 2.3% decrease in the Fund’s portfolio value, which now sits at $542 million, including its investments in the Cromwell Riverpark Trust and Cromwell Property Trust 12. The Fund is 58% hedged, with a weighted average hedge term of just over two years, positioning it well to benefit from potential future interest rate cuts. The Fund’s portfolio is currently 96.4% occupied, with a weighted average lease expiry of 3.6 years. Notably, this lease expiry metric does not include executed leases yet to commence, such as a six-year lease for over 2,100 sqm at 545 Queen Street in Brisbane, starting in March 2025.

In December, the Cromwell Riverpark Trust, of which the Cromwell Direct Property Fund owns 23% valued at just over $32 million, held an Extraordinary General Meeting. Unitholders were asked to vote on extending the Trust’s term through to 31 December 2026. Of the almost 70% of Unitholders who voted, 88% were in favour of the proposal. The decision by Cromwell Riverpark Trust Unitholders to extend the investment term reflects a strategic approach to navigating current market challenges. By allowing more time for market conditions to stabilise and improve, the Trust aims to achieve a more favourable sale price for Energex House. The strong fundamentals of the Brisbane office market, combined with early signs of price stabilisation and potential future decreases in interest rates, support this decision to wait, rather than sell in a depressed market. Cromwell Funds Management will monitor the market closely to determine the optimal timing for launching a formal sale campaign for Energex House, aiming to achieve the best possible outcome for investors.

Cromwell Direct Property Fund’s portfolio is performing well against the 2025 financial year budgets, driven by the expertise of Cromwell’s asset management, projects, and leasing teams. Cromwell’s full in-house management model allows tenants to engage directly with staff on leasing, maintenance, ESG initiatives, and more.

Major capital expenditure projects are ongoing across the portfolio. These include carpet and lighting upgrades at the19 George Street asset in Dandenong, heating improvements at the 100 Creek Street asset in Brisbane, wet wall remediation works at the 420 Flinders Street building in Townsville, leasing works at 545 Queen Street in Brisbane, and lobby, end-of-trip, and carpark façade upgrades at Altitude Corporate Centre in Mascot. These efforts ensure the assets are maintained to a high standard, driving tenant retention and minimising downtime, particularly in multi-let assets such as the buildings at 100 Creek Street and 545 Queen Street in Brisbane.

Sustainability remains a key focus, exemplified by the recent lift upgrades at 100 Creek Street. The new motors provide energy savings of 55% compared to the older ones and regenerate 35% of the power used, feeding it back into the building grid. This initiative delivers both environmental and financial benefits, especially with rising energy costs.

In Adelaide, the team achieved strong leasing results at 95 Grenfell Street. While one tenant surrendered a full floor, they extended their lease on another floor for two years and paid a surrender fee, delivering a positive financial outcome. Terms have already been agreed to re-lease the surrendered floor for five years starting in April, ensuring minimal downtime.

- Data sourced from various ABS publications, except where otherwise specified

- A ‘super’ year for elections, United Nations Development Programme (2024)

- As at 6 January 2025.

Read more about Cromwell Direct Property Fund, including where to locate the product disclosure statement (PDS) and target market determination (TMD). Investors should consider the PDS and TMD in deciding whether to acquire, or to continue to hold units in the Fund.