DigiCo REIT: The hottest initial public offering for several years

Stuart Cartledge, Manager Director, Phoenix Portfolios

Phoenix was peppered with questions about DigiCo REIT (DGT) in the lead up to the stock’s Initial Public Offering (IPO). This article provides a high-level explanation of the demand and supply characteristics of the data centre market along with some comments on DGT specifically and ultimately why we chose not to invest in the IPO.

Industry background

The data centre industry is a critical backbone of the global digital economy, enabling the storage, processing, and dissemination of data across businesses, governments, and individuals. The sector has experienced rapid growth over the past decade, driven by technological advancements, the proliferation of cloud computing, and the increasing importance of data-driven decision-making across industries.

Key demand drivers include:

- Cloud Computing and SaaS: Cloud computing adoption continues to soar, with enterprises migrating workloads to the cloud for scalability and cost-efficiency. Platforms offering Software-as-a-Service (SaaS), such as Microsoft 365 and Salesforce, rely heavily on data centres.

- 5G and IoT: The rollout of 5G and the growth of Internet of Things (IoT) devices generate unprecedented data volumes, necessitating scalable and reliable data storage solutions.

- Artificial Intelligence (AI) and Machine Learning (ML):AI and ML require significant computational power, leading to increased demand for high-performance data centres equipped with GPUs and specialised hardware.

- Digital Transformation:Businesses across all sectors are investing in digital tools and platforms, further boosting the need for robust data infrastructure.

On a conference call in December 2024 with US based Digital Realty, the company described demand growth “greater than anything we’ve ever seen before” and went on to explain how they’ve moved from addressing the need for “growth in the cloud” to “enterprise digital transformation” to a current situation where Artificial Intelligence is accounting for approximately 50% of new bookings.

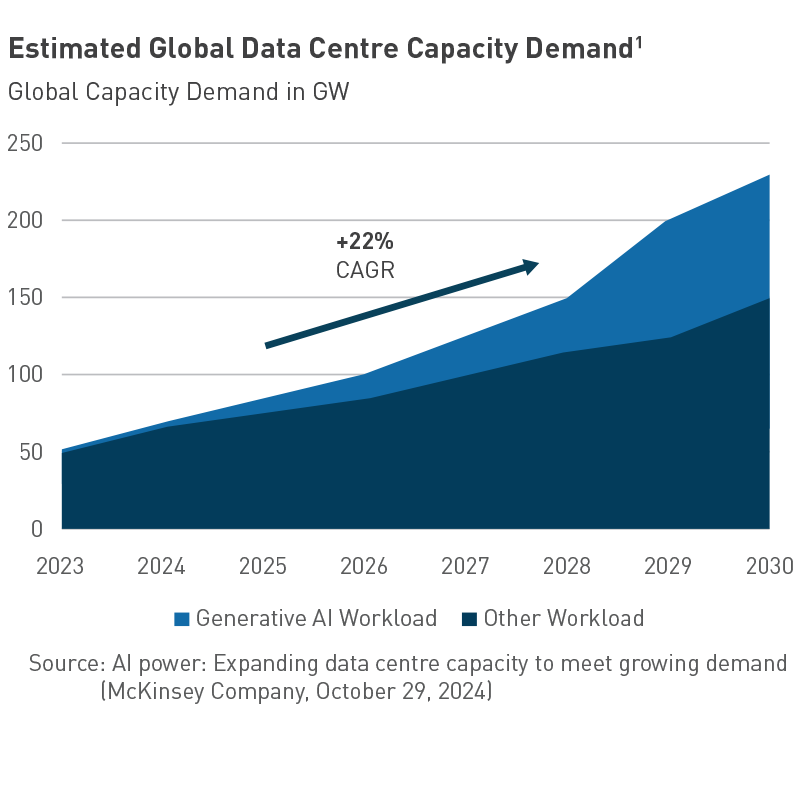

While all forecasts in this space need to be considered carefully, the chart below provides an indication of potential growth.

Supply is being added rapidly, albeit, the physical requirements of land, buildings, IT infrastructure and power can sometimes lag demand. In broad terms, the supply landscape comprises:

- Hyperscalers: Technology giants such as Amazon (AWS), Microsoft (Azure), and Google (GCP) dominate the hyperscale market. These companies continue to invest heavily in expanding their global network of data centres.

- Colocation Services: Colocation providers, such as Equinix and Digital Realty, are also experiencing high demand as enterprises seek hybrid solutions that combine on-premises and cloud storage.

- Enteprise Data Centres: Large organisations such as banks and government, may own and operate their own data centres, specifically tailored to their needs.

- Edge Centres: For certain uses, it is important that data centres are close to end users, helping latency. Edge centres are closely located to end users, but tend to be smaller in scale.