Ignore the noise: Australian office isn’t dead (or dying)

Colin Mackay

The future of offices in a post-pandemic world continues to be a topic of robust conversation.

Arguably, most airtime on the subject has been given to dramatic statements like “expect the death of the office” – perhaps recycling articles from the past decade that incorrectly asserted a retail apocalypse was nigh! The reality is that, as retail has adapted to the internet age – and survived – so too will office spaces adapt to these changing conditions.

It can be easy to fear the worst, especially as reports of landlords handing keys to the bank; assets sitting unoccupied; and valuations declining 80% take up the front page of newspapers.

It’s important, however, to understand that these events have been limited to the US, a challenged market with different financial, social, and real estate context. The outlook for office in Australia is markedly more positive for several reasons.

Higher office occupancy

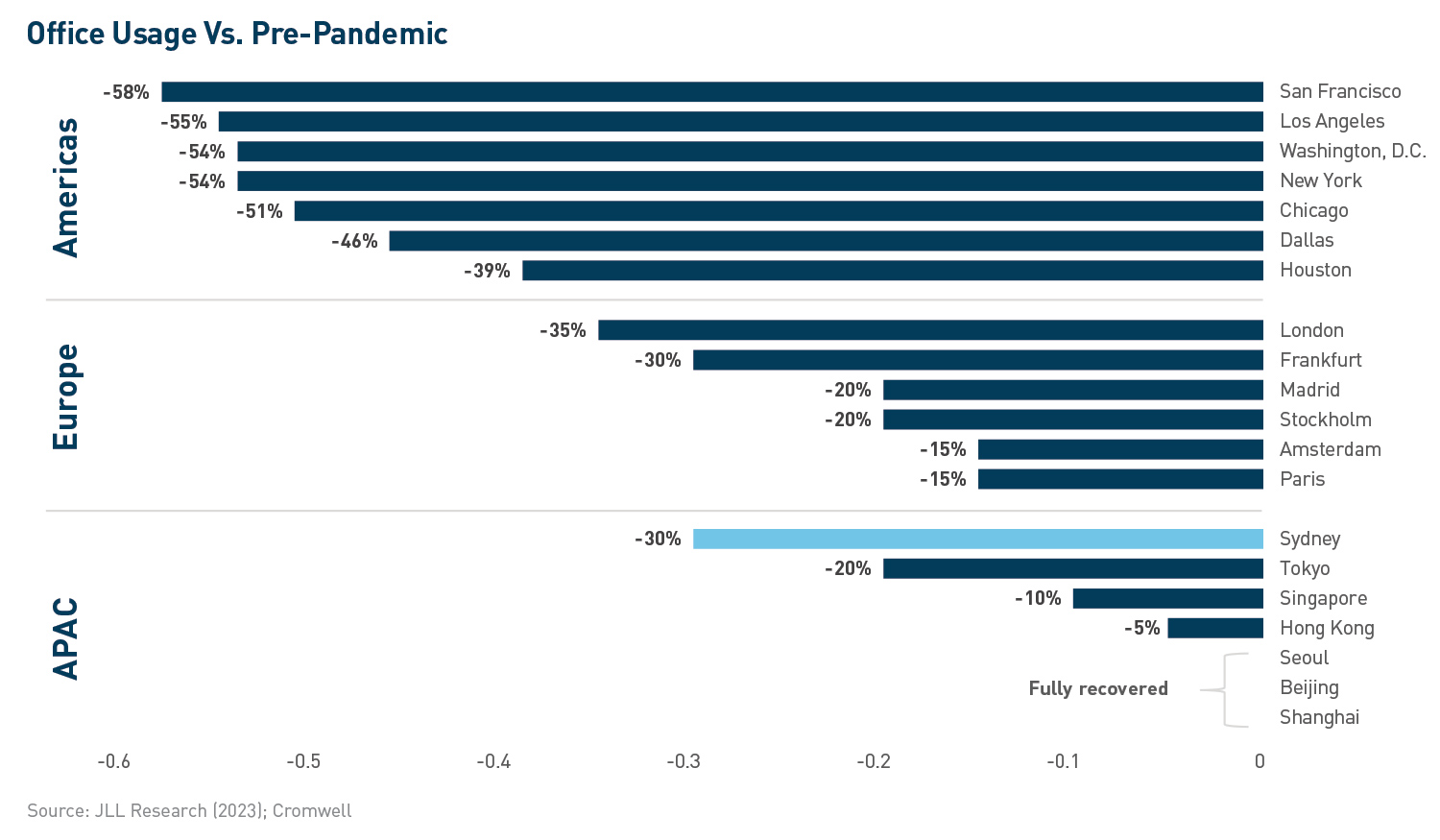

The return to the office has been strongest in Asia-Pacific, where office occupancy is sitting at 70-100% of pre-pandemic levels1. Workers in North America have been the most reluctant to come back to CBDs (45-65%), with Europe (65-85%) splitting the two regions. At the individual market level, the likes of Shanghai and Beijing are back at pre-pandemic occupancy; Sydney has recovered to 70%; London is a bit weaker at 65%; and the major US cities are significant laggards with office-based work still below half of pre-pandemic levels in Chicago (49%), New York (46%), and San Francisco (42%).

Propensity to return to the office appears to be driven by a number of factors, including cultural expectations (e.g., Tokyo/Seoul); industry composition (e.g., finance vs tech); and ease of commute (e.g., rapid transit vs LA traffic). While commute time is highlighted by workers around the globe as the most important driver of returning to the office2, another critical factor is the micro-location of each office building. In addition to influencing commute time, different locations can vary significantly in terms of crime and safety risks, amenity (e.g., restaurants), and environmental desirability (e.g., proximity to water/green spaces).

Australia measures up very attractively on these characteristics, offering reliable rapid transit, exceptional proximity to desirable environmental features, a high density of quality amenity integrated throughout the CBDs, and very low rates of crime. The return to the office will likely gather more steam in the coming months as large employers mandate a minimum number of days in the office per week, as announced recently by NAB and CommBank. However, over the long-term, locations and assets which can attract employees through choice rather than coercion will outperform.

Expanding space requirements

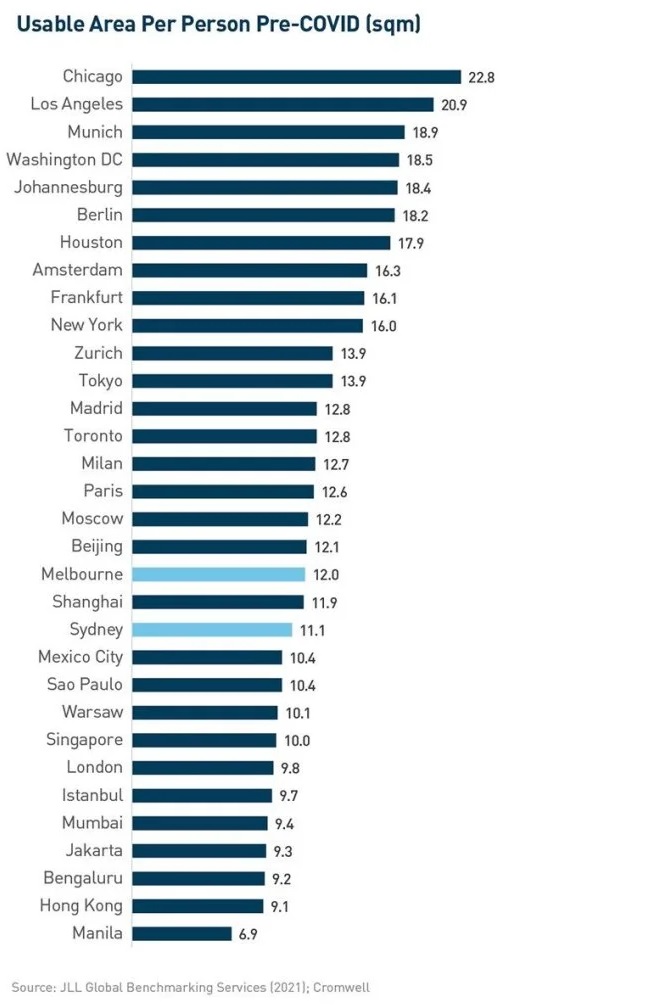

One of the forces expected to offset the impact of remote work is the expansion of workspace ratios – the amount of office space per employee. Forty years ago, in the days of private offices, Australian offices had more than 20 square metres (sqm) of space per employee. Over time, as occupiers sought more “bang for their buck”, desks became more tightly packed together and the corner office was sent to the scrap heap.