Commercial property

Shopping centres, office buildings, industrial properties and other commercial property types may have bigger price tags than your average three-bedroom home, however many of the same dynamics are at play. Like residential property, most commercial property purchases are partly funded with debt. Unlike residential property, where mortgages can commonly comprise 90% of the value of the property, listed commercial property owners in Australia typically employ gearing levels of approximately 30%. Unlike many owner occupiers, commercial property investors require a financial return on their capital. In most cases, this means that debt must be “accretive” to the owner. Put more simply, the cash flow yield of the property should be greater than the interest rate on debt2. A natural relationship that comes from this is that as interest rates increase, the income yield owners require also rises. Assuming the amount of income is stable, this means that the value of the property must go down.

Again, much like residential property, market prices for commercial property are determined by supply and demand. The factors playing into demand are however different to residential markets. Many commercial property investors can, and do, invest across many asset classes. As a collective, their goal is to earn the best return they can in the least risky way possible. To invest in a riskier asset type they naturally require a higher return. An abbreviated list of asset classes and their risk levels can be seen below.

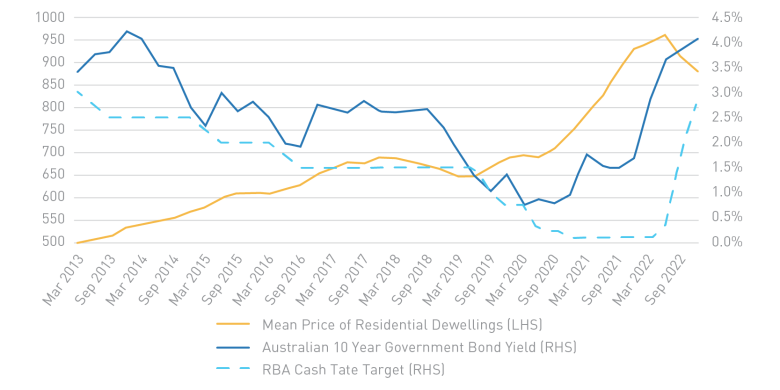

To illustrate this point. The Reserve Bank of Australia’s Target Cash Rate (Cash Rate) has moved from 0.1% to 4.10%. The monthly repayments on a $900,000 mortgage today are equivalent to the monthly repayments on a $1,420,458 mortgage when the Cash Rate was 0.1%. The change in house prices will naturally (inversely) follow changes in interest over time, albeit with somewhat of a lag. This can be seen in the chart on the right-hand side. Note how home prices accelerated when interest rates were at record lows.

To illustrate this point. The Reserve Bank of Australia’s Target Cash Rate (Cash Rate) has moved from 0.1% to 4.10%. The monthly repayments on a $900,000 mortgage today are equivalent to the monthly repayments on a $1,420,458 mortgage when the Cash Rate was 0.1%. The change in house prices will naturally (inversely) follow changes in interest over time, albeit with somewhat of a lag. This can be seen in the chart on the right-hand side. Note how home prices accelerated when interest rates were at record lows.