How did the Cromwell Funds Management fare this quarter?

In April, approximately 25% of the Cromwell Direct Property Fund (DPF) portfolio was revalued, with another 17% in May and 52% in June. Eight of the fund’s nine assets have now been independently revalued. Overall, from December last year, capitalisation rates have softened by 30bps to a weighted average of 7.18%, equating to a 3% fall across the portfolio, which is now valued at $607 million.

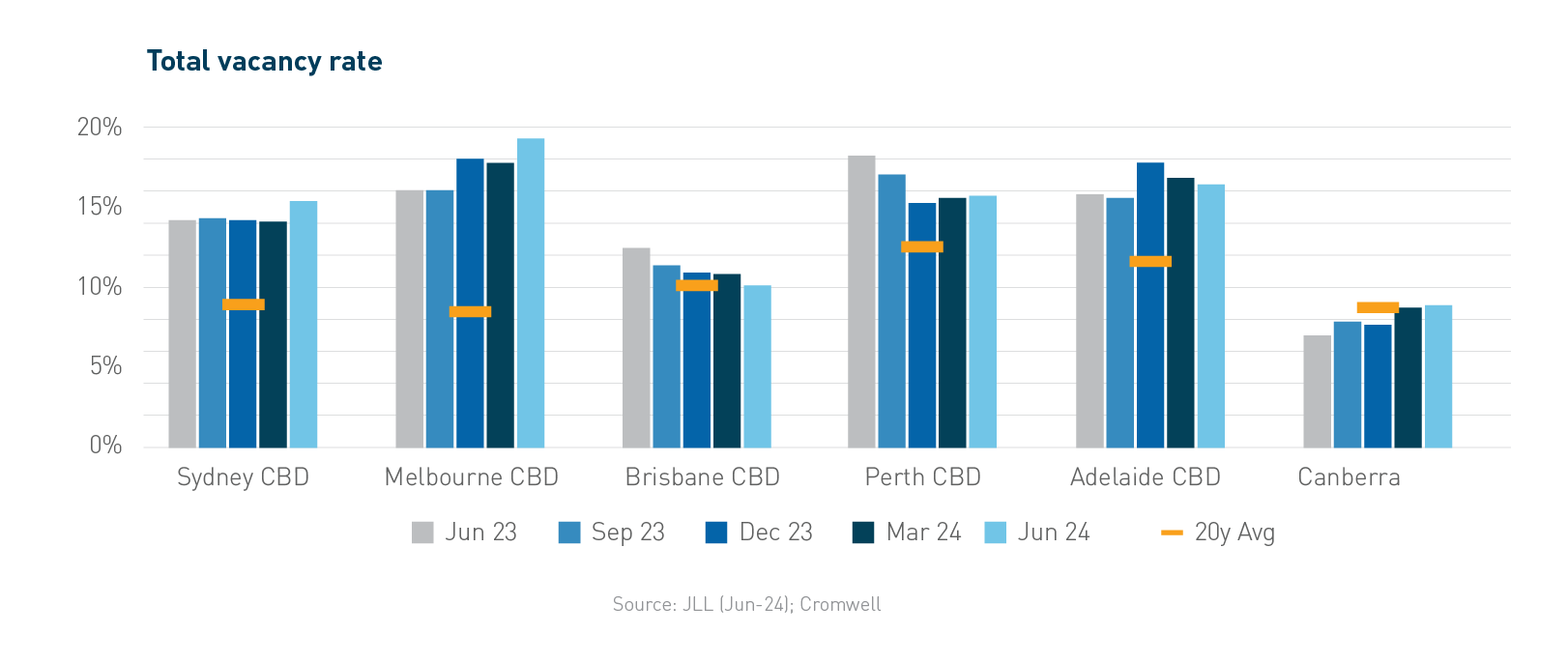

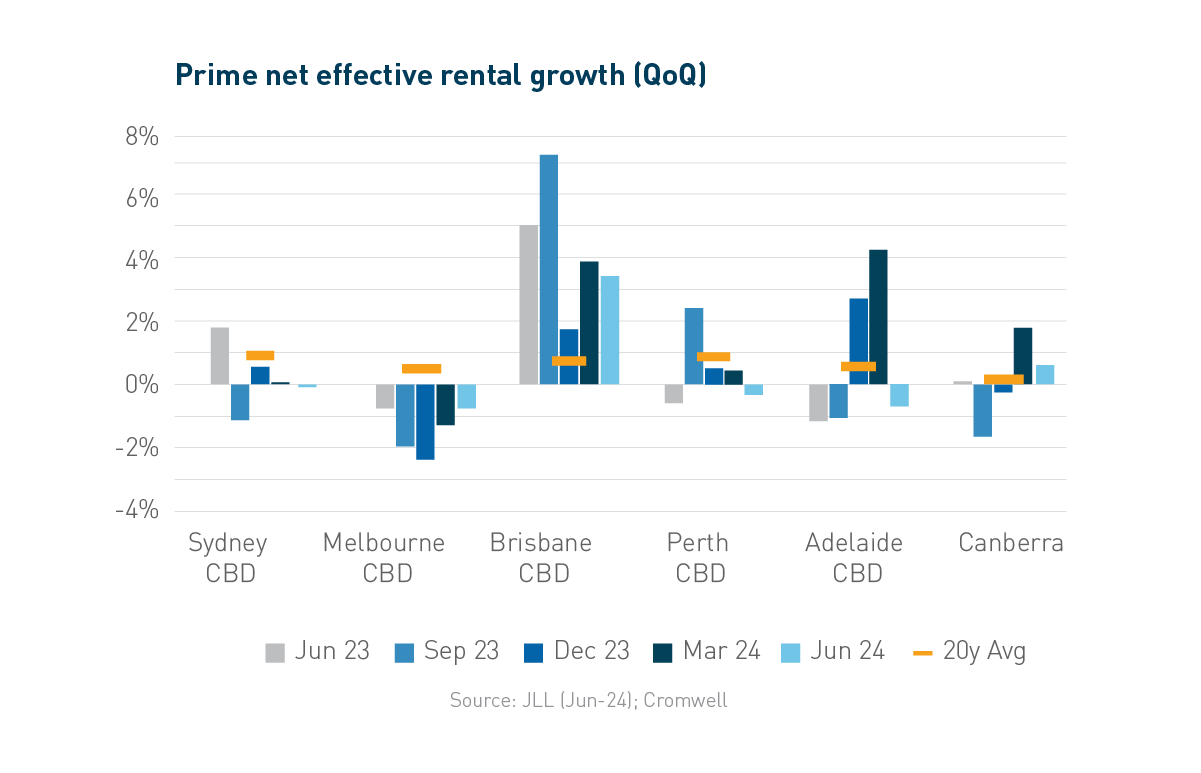

The Brisbane office market, where just under 55% of DPF’s portfolio is held, is experiencing strong fundamentals. This is evidenced by positive net absorption, a decrease in headline vacancy and positive net effective rental growth of 3.4% for the quarter, and 14% over the past 12 months. As noted in the market update above, Brisbane is leading the country for rental growth and is currently one of the strongest-performing leasing markets in the APAC region.

High construction costs and upward pressure on labour, helped along by Queensland’s significant infrastructure pipeline over the next 3-4 years, will see supply constrained for some time, which bodes well for leasing demand and future rental growth on existing assets. Additionally, the anticipated rapid increase in immigration is likely to further drive demand for commercial office space, as well as in the medical, retail, and industrial sectors.

While Cromwell is optimistic that valuations have experienced the worst of the cycle and will now stabilise, it is pertinent to note that recent CPI prints and the Reserve Bank of Australia’s neutral stance on rates may delay this stabilisation. In the interim, Cromwell’s key focus remains on maximizing portfolio performance to help ensure the delivery of regular distributions.

Portfolio updates for the quarter

Cromwell is continuously exploring ways to enhance the tenant experience and improve the amenities offered within its buildings. The implementation of a tenant portal, Cromwell Connect, is currently underway across several of our assets. This portal will enable tenants to access various forms of data, make bookings for communal training or meeting rooms and interact with retailers for services such as ordering coffees, booking dry cleaning, and reserving Pilates classes.

Cromwell Property Trust 12’s (C12) Dandenong asset recently underwent balcony refurbishment works, including the replacement of artificial turf with tiling. Additionally, 100 Creek Street in the Brisbane CBD is undergoing a comprehensive lift modernisation, which includes the upgrade of lift motors, with a heating upgrade project scheduled for later this financial year.

The solar works at Dandenong, Mascot, and Townsville assets have now been completed and energized, resulting in seven of the nine DPF assets benefiting from solar power.

The portfolio experienced strong leasing performance for the quarter, with six deals signed at 100 Creek Street, four of which were completed using existing spec fitouts. The other two were renewals on just under 1,300 sqm. Furthermore, one of the largest tenants at Queen Street exercised a 2-year option over almost 1,500 sqm, and at Mascot, a 5-year renewal with a tenant secured in 2023 was recently completed, occupying just under 1,300 sqm. Cromwell is also receiving good levels of enquiry over a couple of full-floor vacancies in Brisbane and Adelaide.

The portfolio currently maintains a 95.5% occupancy rate, with a weighted average lease expiry of 4 years.

Cromwell’s asset management and projects teams remain hard at work to maximise occupancy across the portfolio, whether by renewing current tenants or relocating them within the buildings using existing fitouts. This approach allows the cost of incentives to be spread across the lease term rather than funded upfront. Moreover, Cromwell is dedicated to maximising energy efficiency and maintaining and improving NABERS ratings through carefully planned lifecycle programmes aligned with decarbonisation plans and ESG initiatives. In April, 545 Queen Street was awarded a 6.0-star NABERS Energy rating for the first time, an improvement from its 5.5 stars. This achievement was the result of years of sustainability planning, energy-saving initiatives, and ongoing consultation with Australian energy solutions provider, Conservia.

Cromwell is pleased to be progressing on its net zero pathway, having already achieved a 73% reduction in emissions across the DPF portfolio3.

Read more about the Cromwell Direct Property Fund: www.cromwell.com.au/dpf.

Past performance is not a reliable indicator of future performance.

Cromwell Funds Management Limited ACN 114 782 777 is the responsible entity of and issuer of units in the Cromwell Direct Property Fund ARSN 165 011 905.

Before making an investment decision in relation to the Fund it is important that you read and consider the Product Disclosure Statement and Target Market Determination available from www.cromwell.com.au/dpf, by calling 1300 268 078 or emailing invest@cromwell.com.au.