Clean income and an attractive yield

In a time of slowing growth and elevated inflation, the ability to generate stable, growing income is an important driver of investment returns. Large Format’s yield nationally is 6.1%6, higher than many commercial and residential property sectors. We also consider the yield to be “cleaner” – what you see is what you get. Compared to major shopping centres for example, which are complex structures with substantial plant and equipment, often less capital expenditure is required to maintain a Large Format asset. This means the post-capex yield, or the money that actually ends up in your pocket, may be more attractive than a simple comparison of headline yields suggests.

The income underpinning the yield also grows over time, in contrast to the fixed nature of bonds. Like the broader retail sector, Large Format leases typically stipulate rent escalation each year of 3-5% or a CPI-linked amount, usually providing growth in excess of inflation. The income stream is dependable, with the majority of Large Format income derived from 5–10-year leases to ASX-listed or national retailers, such as Bunnings, The Good Guys and Freedom.

We believe the runway for rental growth in Large Format is sustainable, given the lower starting level and attractive economics for retailers. Mosaic Brands recently announced plans to open 40 “mega stores” through to Jun-24, as the larger format is 3x more profitable than their normal store size7. For some assets, further growth can be derived from intensification – development of unutilised land, car parks, or air rights into income-generating improvements.

Omnichannel-ready

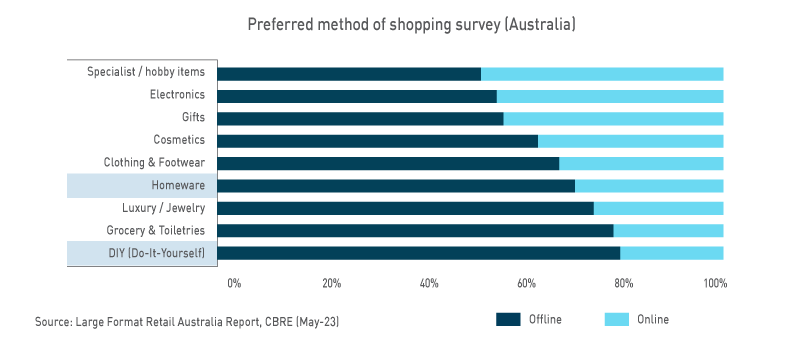

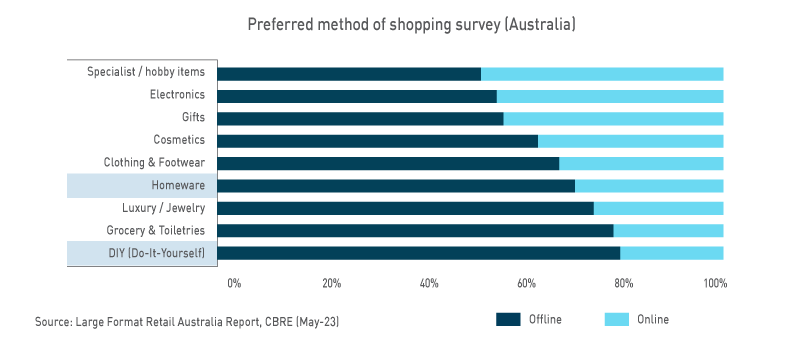

Online’s share of Australian retail trade has increased from 5.1% five years ago to 10.7% today8. The rise of e-commerce has dampened demand for physical retail space relative to household consumption, particularly across discretionary shopping centres with large exposures to categories such as clothing and department stores. Cromwell forecasts online’s share of spending to increase to 20% by 2030, however there are several reasons why Large Format can view the shift as an opportunity, given its role in omnichannel retailing.

From consumers’ perspective, Large Format minimises much of the friction associated with a traditional shopping centre experience – friction which turns shoppers towards e-commerce. Convenience is the number one reason for purchasing online9,10, as large multi-level shopping centres provide a frustrating car parking11 and navigation experience. In contrast, Large Format assets are often a simple rectangular layout with large on grade or basement car parks. These assets can provide the benefits of a physical shopping experience, such as better customer service8 and the ability to touch and trial products12, while minimising the painpoints. In-person shopping is particularly valued across Large Format’s typical retail categories such as homewares and home improvement.

For retailers, Large Format facilitates an improved omnichannel proposition in a number of ways. Rents are typically in the range of $300-600 per square metre, much lower than traditional shopping centres and closer to levels being seen across industrial assets today. Sites are generally large, flat, and designed to be accessible to the heavy vehicles delivering bulky goods to occupiers. Assets are also often well-located, with ample arterial and motorway connections servicing significant population catchments. These attributes make Large Format assets well suited to the full suite of omnichannel product “delivery” options, including buying in store, click and collect, and ship from store, while also offering reasonably cost-effective inventory storage – Nick Scali for example stores 55% of inventory in its showrooms13. In this respect, Large Format can offer investors a quasi-industrial exposure spanning warehousing and fulfilment, with the added fillip of revenue generation (making sales).

The physical store presence also aids in reducing last mile reverse logistics costs14 and processing times15, and provides retailers with an additional opportunity to engage with customers and generate a sale when products are being returned. By offering a seamless omnichannel experience, retailers can drive customer engagement and loyalty.

Customers’ preference for omnichannel is evidenced in trading outcomes, with “Bricks & Clicks” retailers winning online market share at the expense of “Digital Native” retailers16, and multichannel customers spending 2-3x more than single channel customers17. Omnichannel is important to customers and retailers alike, and Large Format’s characteristics can make it a preferred component in that proposition, particularly as e-commerce increases its share of sales and industrial rents reach higher levels.