March 2023 direct property market update

Peta Tilse

Inflation and interest rates were pushed from the front page in March, as the emergence of a US-led banking crisis took centre stage. A month later, the damage appears to have been largely contained to a few US regional banks and Credit Suisse. However, some financial stability risks remain – and banks are expected to adopt a more cautious approach to lending, which could be a headwind for economic growth. In a positive for domestic investors, however, Australian banks are some of the strongest and most resilient in the world and remain on healthy footing.

As banking concerns subsided, attention returned to the outlook for economic growth, inflation, and whether central banks can deliver a “soft landing”. In April, the IMF slightly lowered its global growth forecasts for 2023 and 2024 by 0.1%. to 2.8% and 3.0%, respectively. Inverted yield curves (where short-term interest rates are higher than longer term rates) signal an increased risk of recession in the US, with the UK and Eurozone economies also forecast to contract in 20231.

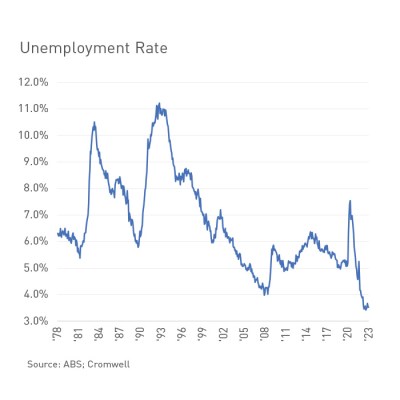

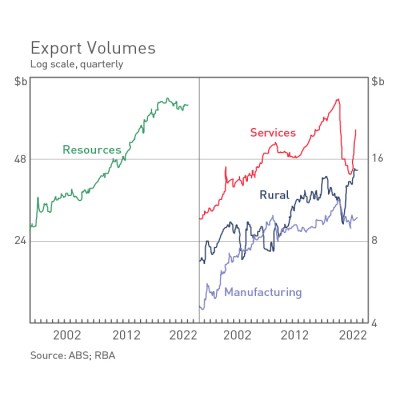

Australia’s outlook is more positive, with the domestic economy’s expansion forecast to continue by 1.0% over 20231. The labour market continues to be a bright spot, with employment rising by 53,000 in March and unemployment remaining unchanged (and very low) at 3.5%2. Exports have also been solid, aided by improvements in the Australia-China trade relationship, with coal exports resuming in the year’s first quarter and tariffs on other products purportedly being reviewed. Significantly, travel restrictions on Chinese students and tourists have been removed, with the increase in student visitors exacerbating Australia’s accommodation undersupply woes.

| Figure 1 |

Figure 2 |

|

|

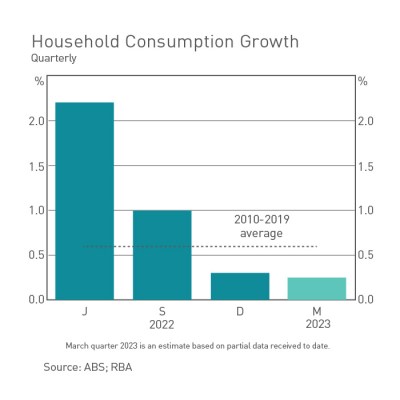

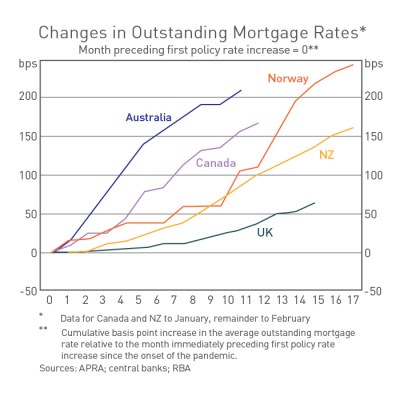

Balanced against these positives is the weakness in the household sector. Retail sales growth slowed to 0.2%2 in February and broader household consumption is running well below trend. Sharply rising mortgage repayments have been the main pressure point, leading to a decline in real disposable incomes. While excess savings that families have built up over the pandemic may have provided a buffer so far, the RBA expects around 15% of households with a variable-rate mortgage will have negative cash flow – i.e., not be able to cover mortgage payments and essential living expenses – by year end. This cash flow pressure, plus pessimistic consumer sentiment, suggests household spending will remain soft over 2023 and below trend (see chart below).

| Figure 3 | Figure 4 |

|

|

Like other central banks around the world, the RBA is expected to be nearing the end of its hiking cycle. The April pause was broadly welcomed; however, as a result of CPI rising 1.4% for the March quarter – and CPI rising 7.0%.over the twelve months to the March 2023 quarter – the RBA has made the decision to raise interest rates once more in May. Whether more hikes are needed in this cycle will ultimately depend on the trajectory inflation takes. The tight jobs market threatens to push wages higher, but the first quarter’s surge of immigration should ease some pressure – though it will worsen the housing shortage and rental inflation. Cromwell’s inflation forecast for 2023 is 6.2%.

Turning to real estate, demand fundamentals held up over the quarter across all the core sectors. Office recorded positive net absorption, led by Brisbane and Perth. Vacancy increased slightly as new supply reached completion but rents still grew across most markets. Strong demand conditions and very tight vacancy continued to benefit industrial, which recorded double-digit rental growth. In retail, vacancy improved across all centre types, with convenience retail outperforming discretionary shopping centres in terms of rental growth.

Transaction volumes were muted over the quarter, but with inflation moderating and interest rates expected to stabilise in the coming months, liquidity should improve and asset prices should find greater stability over the course of 2023. While listed markets suggest assets face sizeable devaluations, REITs typically experience bigger swings (both up and down) than what happens on the ground. An expansion of cap rates is expected, but income growth may limit the impact to asset valuations.

Outlook

The Australian economy remains in a solid position, despite global headwinds. Inflation is showing signs of slowing, employment is solid, and population growth will provide support to demand over the course of the year. The rate hiking cycle is nearing its end, and financial stability has been maintained despite ructions in the US and Europe.

These factors put the Australian commercial property market in good stead. Businesses continue to adjust size requirements for occupancy as hybrid working continues across industries, although in certain markets this is now largely known. Experiential workplaces with clever refurbishments and amenity continue to attract and retain quality tenants; something Cromwell continues to see within our assets. Capital continues to view Australia as a favourable investment destination, given its attractive demographic profile, growth prospects, and relative social and political stability.

Powerful megatrends – such as the need for more sustainable, energy efficient real estate and rising demand for segments serving the modern economy (such as urban logistics, data centres and highly amenitised offices) – will create income growth opportunities.

How did Cromwell Funds Management fare in the first quarter?

The Cromwell Direct Property Fund (DPF) had no major transactions this quarter and no valuation updates.

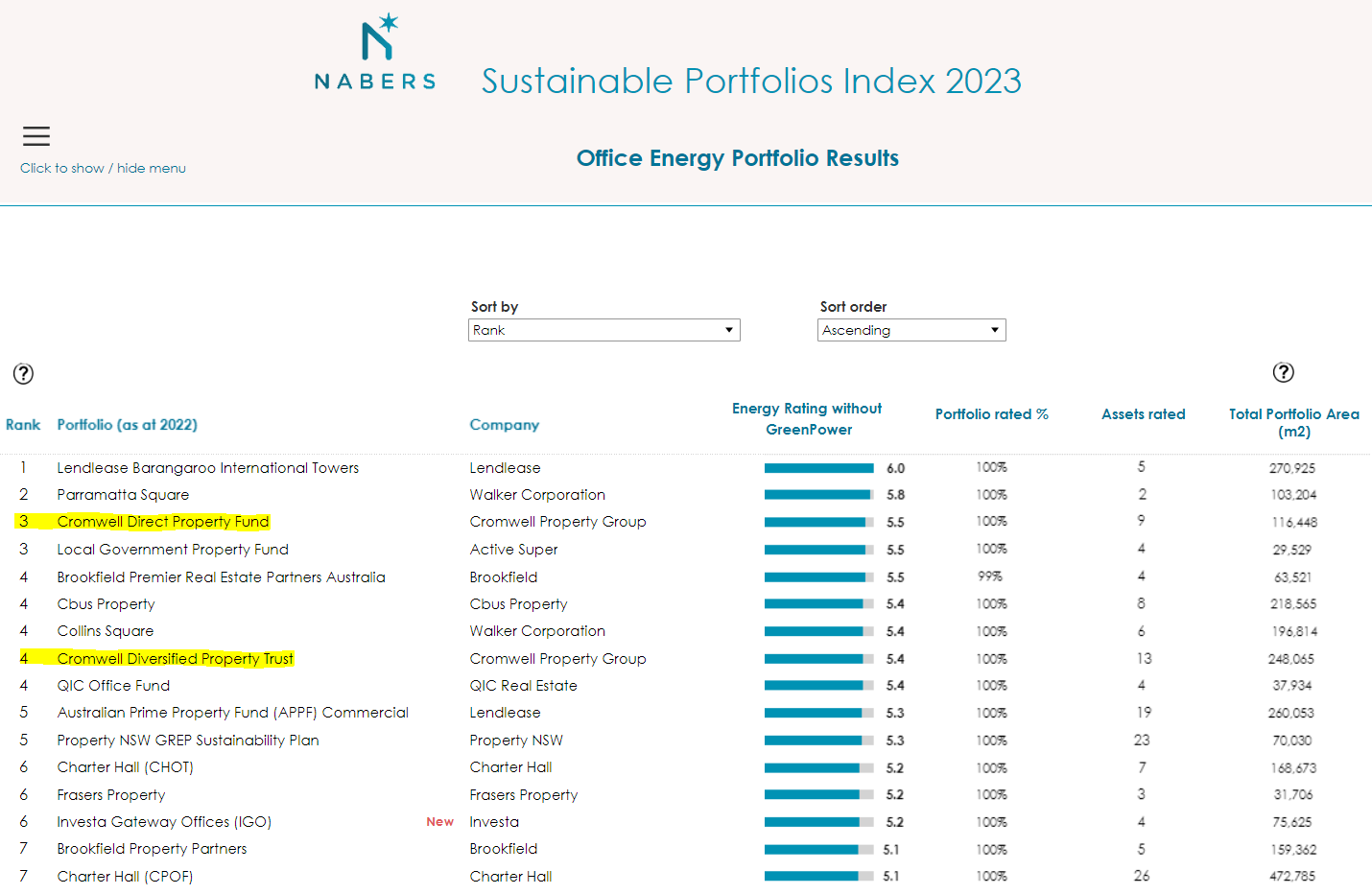

The DPF came 3rd among 64 Australian property funds vying for the NABERS 2023 Sustainable Portfolio Index. Cromwell Group’s Diversified Property Trust came an equally respectable 4th place.

It speaks to Cromwell’s expertise in the all-important ESG space to have a fund with 9 properties of varying ages (including Creek St Brisbane completed in 1977 and Queen St Brisbane 1982) compete so strongly against assets that have been completed within the last 10 years (the winner Barangaroo completed in 2016 and runner up Parramatta Square in 2022).

This is a testament to our hard-working Property Team, which constantly monitor and manage our assets from the ground up, optimising operational efficiencies as well as providing superior tenant experience.

Performance (%) p.a as at 31 March 2023

| Year | Cash (AU) | Bonds (AU) | Shares (AU) | Cromwell Direct Property Fund3 |

| 1 | 2.04% | 0.35% | -0.57% | 0.13% |

| 3 | 0.73% | -2.37% | 16.59% | 5.95% |

| 5 | 1.08% | 1.27% | 8.64% | 6.44% |

Source: Lonsec and Cromwell Funds Management

1. Capital Economics

2. ABS

3. Based on current distributions of 6.75 cents per unit p.a. and a current unit price of $1.2646 as at 31 March 2023