March 2025 direct property market update

Economy1

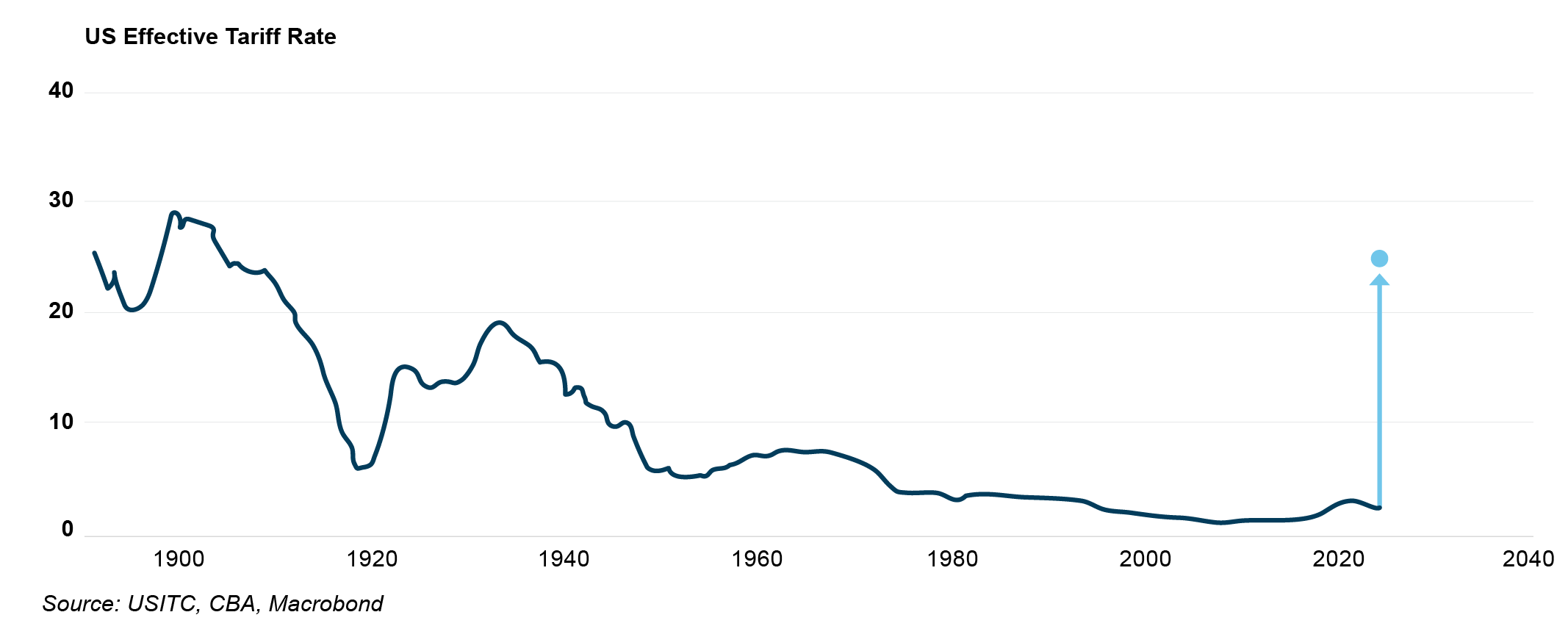

Events of the March quarter have been completely overshadowed by President Trump’s Rose Garden address on 2 April where he announced a universal 10% tariff would be applied to all US imports from 5 April, with higher tariffs to be applied from 9 April against countries with trade surpluses with the US. Taking the measures as announced, the US’s effective tariff rate is expected to increase to around 25%, a level last seen in the early 1900s2.

In the near-term, a key impact to markets and the economy is heightened volatility and uncertainty. Indeed, product exemptions and a 90-day pause on the higher tariff rates (excluding China) have already been announced. While one of Trump’s stated objectives is to incentivise investment into US manufacturing, it will be challenging for companies to commit substantial capital and resources when the landscape could shift significantly by the time these words go to print, let alone the several years which would be required to reorganise supply chains and build facilities.

Equity and bond markets have seesawed as the prospect of stagflation – higher inflation and lower growth – shakes confidence. Positively for Australia, we’re better positioned than most to weather the storm. On the whole, direct trade impacts should be limited given the US only accounts for 4% of Australian exports3. Indirect impacts via a weaker Asian economy are a risk, and the extent of policy support in China will be closely watched. The floating Australian dollar is acting as a shock absorber, depreciating in value and enhancing the attractiveness of our key commodity exports.

Economic conditions at home are also in good shape. The labour market is healthy without being so tight as to cause inflationary wage pressures, the public sector is in a position to provide supportive spending if needed, and the RBA has scope to stimulate the economy via monetary policy. In February, the RBA made its long-awaited first interest rate cut, reducing the official cash rate to 4.1%. Looking ahead, National Australia Bank (NAB) expects further easing, forecasting a 50bps cut in May, followed by 25bps reductions in July, August, and November—potentially taking the cash rate to 2.85% by year-end. Other major banks predict a slightly slower pace, but all anticipate a more supportive interest rate environment, which bodes well for increased transactional activity and continued market recovery.