Stock in focus: Retail Value Inc

The Cromwell Phoenix Global Opportunities Fund (GOF / Fund) searches for investments with unique qualities that are hard to discover, yet simple to value. Spinoffs provide a fertile hunting ground for these types of situations and Phoenix Portfolios uncovered one in Retail Value Inc (RVI).

A spinoff occurs when a larger business takes a subsidiary, or part(s) of its existing business, separates it into a new, independent company and in most cases distributes shares in the newly separated entity to existing shareholders, whether they like it or not.

Thankfully for us, many existing shareholders do not like it, as the spun company is commonly a lot smaller and/or ‘non-core’ to the broader business. At times this can create strong selling pressure and a wonderful opportunity to purchase the spun off security at a large discount. RVI is an example of an investment that Phoenix naturally gravitates to.

In July 2018, RVI spun out from long-time US-listed shopping centre owner, Developers Diversified Realty (DDR) (more seasoned investors may have some painful memories and financial scars from the formerly Australian-listed Macquarie DDR Trust).

At inception RVI was to own 50 shopping centres, comprised of 38 in the continental United States and 12 in Puerto Rico. RVI was to be externally managed by DDR and had an explicit mandate of selling those assets over 36 months and distributing the proceeds to shareholders.

The assets placed into RVI were described as ‘stable but lower growth’ in the registration document associated with the spinoff. Furthermore, the Puerto Rican assets were said to ‘present uncertain future cash flows because of macroeconomic factors’.

Translating this from ‘business speak’ to plain English, DDR was handpicking its 50 worst assets and selling them because it no longer wanted them.

Readers may be wondering who in their right mind would want handpicked ‘bad’ shopping centre assets. This would be an astute observation and it seems DDR shareholders didn’t want that exposure either. Six months after initially trading at more than $36 per share, RVI’s share price was approximately $25.50 per share (dropping ~30%).

Despite the poor share price performance, RVI was achieving solid asset sale prices, significantly ahead of what was implied by the share price and appeared to be executing on their stated strategy admirably. While this looked like an attractive opportunity, this occurred approximately 12 months before the initiation of the GOF. In that 12-month period, RVI continued to deliver on its stated goal of selling assets in a methodical manner, achieving robust sales prices.

Investors started to believe that despite the flaws, the company may present a compelling investment opportunity. As such, the stock price rallied to approximately $39 per share. By the inception date of the Fund, it no longer presented a compelling investment opportunity and as such it was not held. Despite this, it was not forgotten.

Phoenix continued to track RVI’s progress as it continued to sell properties. The period beginning March 2020 presented a tumultuous time, with uncertainty around the ability to collect rent and sell assets as COVID-19 and associated restrictions spread around the world. A restoration of relative normality and more conducive financial markets allowed asset sales to restart in 2021. To July 2021, the vast majority of the assets sold were located in the Continental US. The initial 38 mainland assets were whittled down to only eight, whilst nine of the initial 12 Puerto Rican assets remained.

The Fund aims to invest in areas within the team’s circle of competence. Mainland US retail assets very clearly fit into this, however with the majority of assets in Puerto Rico and limited knowledge of that market, the variance of possible outcomes was too wide to accurately assess.

Who would even bid on a large-scale portfolio of Puerto Rican shopping centres?

The answer was Kildare Partners, a real estate private equity fund run by Ellis Short (some may remember Short as the former owner of English football team Sunderland AFC, also a key character in Netflix documentary Sunderland ‘Til I Die). The $550 million headline price was a very solid outcome, however, there was set to be more than a month between the announcement and cash payment. With such a substantial transaction in a developing jurisdiction, the risk of not closing on the deal seemed high.

In August, it was announced the full cash proceeds had been received. The stock price was unmoved on the announcement and RVI was being valued at a discount to Phoenix’s assessment of the value of what was left. Eight US shopping centres and a big ‘pile’ of cash. As such, we finally initiated a position in RVI.

Investors didn’t have to wait long for further activity. In October 2021, the company announced the sale of five further assets. Phoenix first paid $24.30 per share to acquire a stake in RVI. Two months later, RVI announced a $22.04 special dividend to shareholders, meaning more than 90% of our initial investment was to be returned, along with a holding in the remaining three assets and a smaller but still meaningful ‘pile’ of cash. After the dividend was paid, what was left of RVI traded at a value that was once again attractive to Phoenix and, as such, more RVI shares were purchased at a price of $6.00. Again, it was a short wait for further positive outcomes, with two of the remaining three assets sold and a further $3.27 dividend announced in December 2021.

In March 2022, RVI announced the sale of the final asset and a plan to delist the company from the New York Stock Exchange. With this sale, the only meaningful asset of RVI was (you guessed it) a pile of cash. This amounted to approximately $3.90 of cash (and receivables) per share.

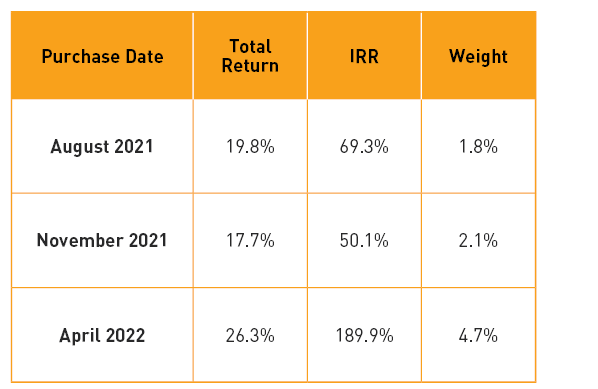

Table 1: RVI share purchases

The last day of trading for RVI stock was to be 6 April 2022. Some investors cannot own delisted securities and are therefore required to sell before delisting occurs. Ready for this, the Fund amassed some cash to get ready for a potential attractive opportunity. The market was co-operative, offering RVI stock for $3.00 per share. With such an incredible risk / reward trade off, Phoenix made RVI a larger position in the Fund.

Six days later a $2.13 dividend was announced, returning more the 70% of the money invested prior to delisting. In June, a further $1.16 dividend was announced. This means that only three months after paying $3.00, RVI will have returned $3.29 to shareholders, with future additional distributions of the remaining $0.61 per share of cash (less wind-up costs) highly likely.

The Fund made three separate purchases of RVI shares. The likely financial outcome of each purchase is outlined in the table 1. From the table above it can be seen that the most attractive opportunity (and largest position taken by Phoenix), occurred when RVI had only cash left on its balance sheet. Due to timing and US GAAP accounting quirks, investors had to be following the RVI situation to discover this opportunity.

When describing the strategy of the Fund, we often discuss the metaphor of buying a dollar of assets for 50 cents, with the goal of getting one dollar (or more) back at an uncertain future date. In this case, a dollar of cash was literally purchased for less than 75 cents, with the very high expectation of receiving a dollar back within six months. RVI has resulted in a strong outcome for investors, and we continue to hunt for more opportunities like it.