Supply: Much of the market does not meet modern occupier need

Occupier demand has shifted rapidly to reflect these requirements, but supply takes longer to realign. Though office space overall may be oversupplied if less space is needed per worker, the provision of space that meets today’s occupier demand is arguably undersupplied. Furthermore, this demand is concentrated predominantly on CBD locations that minimise commute times and maximise access to amenity, further widening the demand-supply gap.

According to JLL data, prime office space comprises just one quarter of the total office space within Australia’s five main CBDs. Prime vacancy in Sydney and Melbourne CBDs is above average but, as lease events occur, it is likely that this space will be absorbed by occupiers relinquishing older quality space within the CBD or suburban locations – perhaps taking a smaller footprint overall but paying more per square metre for it. In addition to prime CBD space, we expect buildings with character – such as former warehouses or heritage buildings – in amenity-rich, accessible fringe locations will attract strong occupier interest.

Implications: Filling the supply gap will deliver returns

The conditions of high occupier demand for a specific type of space and low supply create a compelling strategy for owning, buying, or creating quality stock that is suitable for modern occupiers in CBD and select fringe locations. Offices continue to be impacted by negative investor sentiment associated with cyclical economic conditions and uncertainty over the future of work. However, rational analysis of prevailing structural themes and market trends suggests that acting with conviction now to construct portfolios that provide the space modern occupiers want will deliver solid returns. With the right strategy, the greatest performance potential lies in targeting poor quality, unloved office space in good locations which can be upgraded to todays’ standards.

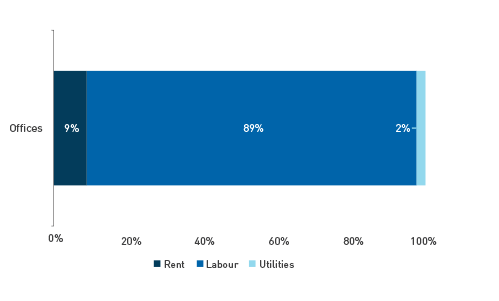

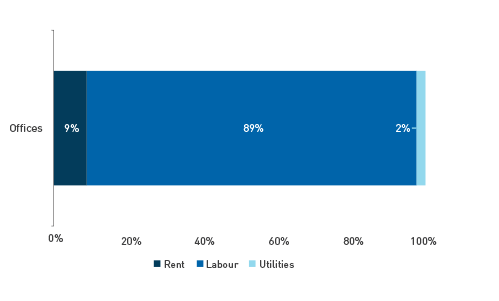

Figure 3: Typical cost structure for office occupiers

Source: Cromwell Property Group/Wall Street Journal, Q1 2023

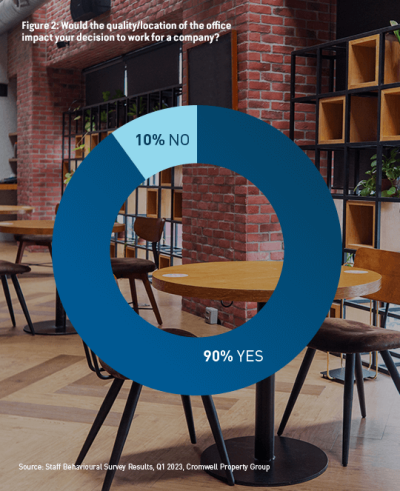

Occupier competition for suitable space is likely to support rental growth, even in a higher inflationary environment. Our analysis shows that for the typical office occupier, rental costs constitute a mere 9% of total operational costs (Figure 3). If leasing better quality office helps to increase the ability of a company to attract and retain labour – a far larger cost item – and support labour productivity, they will pay more for it.

Over the last 25 years, analysis of prime rental growth in Australia’s five main CBDs against CPI shows that in all cases, rental growth has exceeded inflation. In today’s hybrid working world, the business-critical importance of suitable office space combined with its limited supply will create an even stronger rental growth impetus regardless of the inflationary and economic growth outlook.

Occupier competition for suitable space is likely to support rental growth, even in a higher inflationary environment.

Conclusion: bifurcation of demand implies strong future performance for the best space

The demand for office space has evolved rapidly over the last few years and supply has not kept pace. As demand continues to concentrate on the minority of space suitable for modern occupation, the supply-demand mismatch will widen. Investors who own or can acquire or create the space occupiers want where they want it are well positioned for future rental growth.

Footnotes