Learn

The Cromwell Riverpark Trust (the Trust) was the first of Cromwell’s ‘back to basics’ single property trusts, launched in February 2009 to fund the acquisition and construction of Energex House. The anchor tenant, Energy Queensland Limited, is one of Australia’s largest and fastest growing energy suppliers and occupies 94% of the 30,601 sqm of net lettable area of the building on a long lease.

As one of Queensland’s most energy efficient commercial buildings, Energex House has earned a Six Star Green Star rating and a 5.5 Star NABERS rating.

Market challenges at the end of the second Investment Term

Following the end of the second investment term of the Trust in 2021, efforts to sell Energex House did not yield offers deemed to be in the best interests of Unitholders. A preferred bidder entered due diligence in March 2022 however, during this period, market conditions changed dramatically.

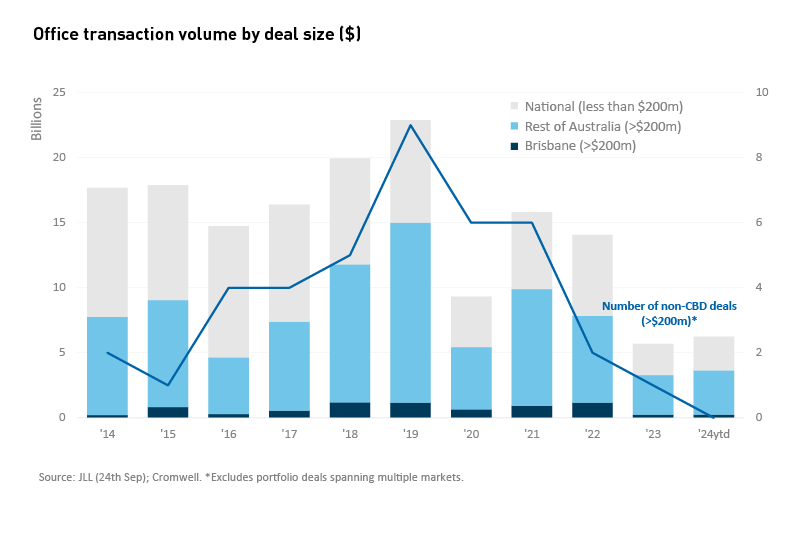

The RBA’s increase of the cash rate on 3 May 2022, along with subsequent movements in debt markets, resulted in the preferred buyer ultimately withdrawing in late May 2022. This was followed by nine consecutive cash rate target increases, totalling 13 by November 2023, marking the sharpest and second-longest hiking cycle in the history of the Australian cash rate. In such an environment, long-term real estate investors often withdraw from the market due to increased volatility and uncertainty, particularly for larger assets.

Consequently, transactional activity within the office market fell dramatically to its lowest levels in over 10 years, both in terms of dollar value and the number of deals. Asset sales that have occurred over 2024 have continued to show significant discounts to book values.

Currently, buyers are typically pricing opportunistically, which is not conducive to achieving a favourable sale price for the property. Given these conditions, extending the investment term of the Trust was recommended as the best course of action.

Unitholders vote on Term Extension

In late October 2024, Cromwell Riverpark Trust Unitholders were invited to vote on a Term Extension Proposal for the Trust. Of the 69.69% of unitholders who voted, 88.01% were in favour of extending the investment term until 31 December 2026. This extension aims to allow Energex House to be sold in a more orderly market when long-term buyers become more active and create a more competitive environment.

Why wait?

Early signs of price stabilisation in the office market have emerged, with the rate of yield expansion beginning to slow. Increased stability in pricing may attract a larger pool of market participants and hence contribute to greater transaction volume. Combined with the potential for future decreases in interest rates, this should help in creating more confidence with potential purchasers.

With limited new supply completed over the quarter and the demand side of the equation proving solid, the national CBD vacancy rate improved from 15.4% to 15.1%. Every market except Melbourne CBD and Brisbane CBD saw vacancy decline, with Sydney CBD (-0.9%) the standout due to its strong quarter of demand. Canberra and Brisbane CBD remained the tightest markets – their vacancy rates are in line with or tighter than the long-term average.

Strong fundamentals for Brisbane Fringe

Office space market fundamentals for the Brisbane fringe market have been improving and show good performance relative to other markets. Recent tenant demand for prime Brisbane fringe office space has been strong, with the Fortitude Valley precinct leading the Brisbane fringe sub-market in total occupied space growth since the onset of COVID-19.

This strong demand has contributed to a fall in the vacancy rate. A constrained supply pipeline is expected to keep the vacancy rate low, fostering conditions for rental growth. The Brisbane fringe has recorded the second-strongest rental growth nationally since December 2019, second only to the Brisbane CBD.

The decision by Cromwell Riverpark Trust Unitholders to extend the investment term until 31 December 2026 reflects a strategic approach to navigating current market challenges. By allowing more time for market conditions to stabilise and improve, the Trust aims to achieve a more favourable sale price for Energex House. The strong fundamentals of the Brisbane office market, combined with early signs of price stabilisation and potential future decreases in interest rates, support this decision to wait, rather than sell in a depressed market.

Cromwell Funds Management remains committed to monitoring the market and will initiate a formal sale campaign when conditions are deemed favourable, aiming to ensure the best possible outcome for unitholders.